Automating Routine Banking Transactions Using AI

In an age where technology is reshaping industries, banking stands at the forefront of this transformation. With the rapid adoption of AI in banking automation, financial institutions are beginning to understand that integrating artificial intelligence (AI) not only streamlines operations but also enhances customer experiences. The need for effective banking automation has never been more evident, especially with increasing demands for faster, more personalized services. Here’s how automated banking transactions are set to revolutionize the industry.

The Need for Banking Automation

As consumers demand seamless experiences akin to what they encounter in retail environments, banks are feeling the pressure to modernize their processes. Traditional banking operations are often slow, cumbersome, and outdated, creating significant bottlenecks. This is where AI comes into play, offering an efficient solution to automate routine tasks, reduce operational costs, and enhance customer interactions.

Key Areas of Automation

- Loan Processing: AI-driven systems can significantly cut down the time required for loan approvals. By utilizing machine learning for credit assessments, banks can process applications in seconds rather than weeks, limiting customer wait times and enhancing satisfaction levels.

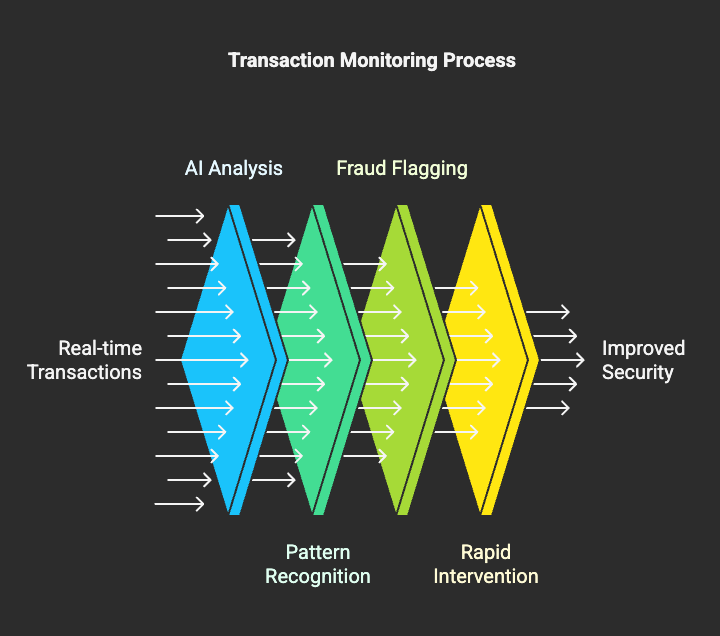

- Transaction Monitoring: Thanks to AI and machine learning, financial institutions can monitor thousands of transactions in real-time. Patterns indicative of fraud can be flagged automatically, allowing for rapid intervention and improved security.

- Compliance and Risk Management: Regulatory frameworks are continuously evolving, and banks must stay compliant while managing risks. AI can automate compliance checks, ensuring that transactions meet the latest regulations and freeing personnel from tedious manual audits.

- Customer Service Automation: With AI chatbots handling routine inquiries, banks can provide 24/7 customer support, ensuring that clients receive immediate responses to their queries without waiting hours on hold.

- Data Management and Analysis: Automating data entry, reconciliation, and reporting reduces errors associated with human intervention and allows banks to make informed decisions based on accurate, real-time data.

SimplAI's Role in Banking Process Automation

At SimplAI, we believe that the integration of AI with banking processes is not just an option; it is essential for future success. Our platform allows banks to develop complex, high-accuracy Agentic AI applications quickly and effortlessly. Here’s how our solutions can address common challenges in banking:

Enhancing Efficiency

By using our platform, banks can automate repetitive tasks across various banking operations—from loan approvals to compliance checks. Increased efficiency translates into cost saving and optimized resources.

Improving Decision-Making

With AI-powered analytics, financial institutions are equipped with enhanced decision-making tools. SimplAI enables banks to instantly analyze large datasets, ensuring that they can respond to market shifts and customer needs smartly and proactively.

Fostering Personalization

As customers increasingly expect personalized banking experiences, our solutions empower banks to use AI to tailor offerings and engagement strategies to individual preferences. This not only enhances customer satisfaction but also fosters long-term loyalty.

Seamless Integration with Existing Systems

SimplAI’s solutions are designed to integrate smoothly with legacy systems, mitigating the common integration headaches faced by banking institutions. This ensures that banks can modernize without completely overhauling their existing infrastructure.

Conclusion

Automating routine banking transactions with AI is set to redefine the financial landscape. From enhancing customer experiences to improving operational efficiency, the benefits are profound and far-reaching. As we move further into the digital age, banks that embrace AI-led automation will be better positioned to thrive in a competitive marketplace.

What steps is your bank taking towards automating routine transactions? Are you ready to join the ranks of industry leaders transforming banking with AI technology?

Explore how SimplAI can support your journey in shaping the future of banking. Let us help you build high-accuracy AI applications that address your specific needs. Contact us today for a demo or to learn more about our offerings!