Enhancing Client Engagement in Wealth Management with AI

In today’s rapidly evolving financial landscape, wealth management professionals face immense pressure to deliver personalized, efficient services that cater to their clients' unique needs. As client expectations rise, so too does the vital need for innovative solutions. By harnessing AI, firms can not only improve their operational efficiency but also significantly enhance the overall client experience. In this blog, we'll explore various ways AI is enhancing client engagement in wealth management and discuss actionable strategies to integrate these advanced technologies into your practice.

The Landscape of AI in Wealth Management

The integration of AI into wealth management processes is not just a trend; it’s a necessity. According to Accenture’s latest North American Wealth Management Advisor Survey, a staggering 96% of financial advisors believe that generative AI can reshape client servicing and investment management. Moreover, the global market for AI in wealth management is projected to reach nearly $6 trillion by 2027 (source: Accenture). This growth highlights both the opportunities and challenges firms face in adopting and utilizing AI.

Improving Client Experience with AI

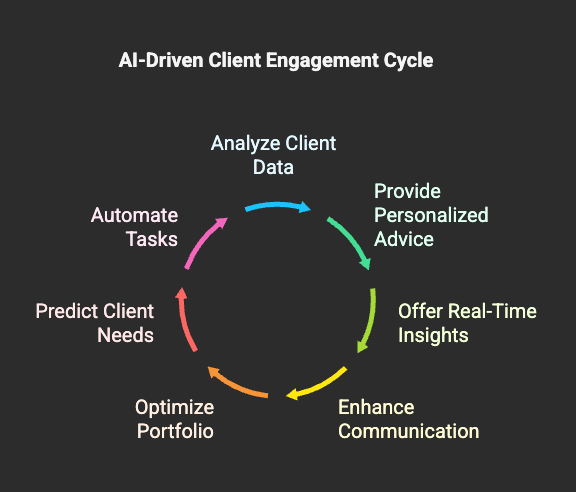

AI in financial services offers several significant benefits that can directly enhance client engagement. Here are some key strategies to consider:

1. Personalized Financial Advice

AI algorithms can analyze vast datasets, including historical performance, market trends, and individual client preferences. By tailoring investment strategies to each client's specific goals and risk tolerances, advisors can create a deeply personal experience. A well-designed AI system can even predict which investment opportunities align best with a client's financial objectives.

2. Real-Time Insights

With AI, wealth managers no longer have to wait for quarterly reports to make informed decisions. Instead, they can access real-time data that enables proactive adjustments to investment strategies. This immediate responsiveness not only enhances client trust but also helps secure better outcomes.

3. Enhanced Communication

AI-powered chatbots and virtual assistants can provide clients with real-time support, responding to inquiries quickly and accurately. Enhanced communication tools can lead to more meaningful interactions, as clients are kept informed about market movements and investment opportunities even outside regular meetings.

Client Engagement Strategies AI

Integrating AI-driven solutions into your wealth management practice can unlock new and innovative avenues for client engagement, led by the following strategies:

1. AI-Based Portfolio Management

AI algorithms can efficiently analyze a client's portfolio and offer tailored recommendations for optimization. This ensures that investment strategies remain aligned with changing market conditions and client goals. Generative AI can even perform real-time portfolio rebalancing, ensuring optimal asset allocation.

2. Predictive Analytics

Leveraging predictive analytics can help advisors anticipate client needs before they arise. By analyzing patterns in client behavior and market dynamics, advisors can proactively recommend adjustments to portfolios or financial plans that are aligned with emerging trends.

3. Automating Routine Tasks

AI can help advisors by automating administrative functions such as compliance checks, document processing, and client reporting. These efficiencies not only free up time for wealth managers to focus on higher-value tasks, but they also improve accuracy and reduce operational errors.

The Role of SimplAI in Wealth Management

At SimplAI, we understand the importance of harnessing the power of technology to drive client engagement. Our platform offers the fastest and simplest way to build complex, high-accuracy AI applications tailored to the specific needs of wealth management. With SimplAI, you can automate routine tasks, gain real-time insights, and enhance personalized financial advice - all while ensuring compliance with regulatory standards.

Conclusion

As the wealth management industry continues to embrace AI technology trends, the potential for enhancing client engagement is vast. By leveraging AI-driven strategies, firms can deliver a superior client experience while driving operational efficiencies.

Are you ready to take your client engagement to the next level with AI? How do you currently utilize technology in your wealth management practice?

At SimplAI, we're here to help you transform your advisory practice with our powerful AI solutions. Explore our platform today and discover how we can assist you in unlocking new potential in client engagement.