AI-Driven Automation in Wealth Management

As the wealth management industry evolves rapidly, one prominent trend is the rise of AI-driven automation, revolutionizing how financial advisors operate and how clients interact with their investment strategies. This evolution not only enhances operational efficiency but also significantly improves client engagement and satisfaction, as firms strive to meet the seamlessly personalized experiences clients expect.

In this blog post, we'll explore how AI in wealth management is transforming the industry, the benefits of automation in financial services, and the implications of AI-driven investment strategies. Let’s dive deeper into how this shift offers significant advantages for wealth managers and their clients alike.

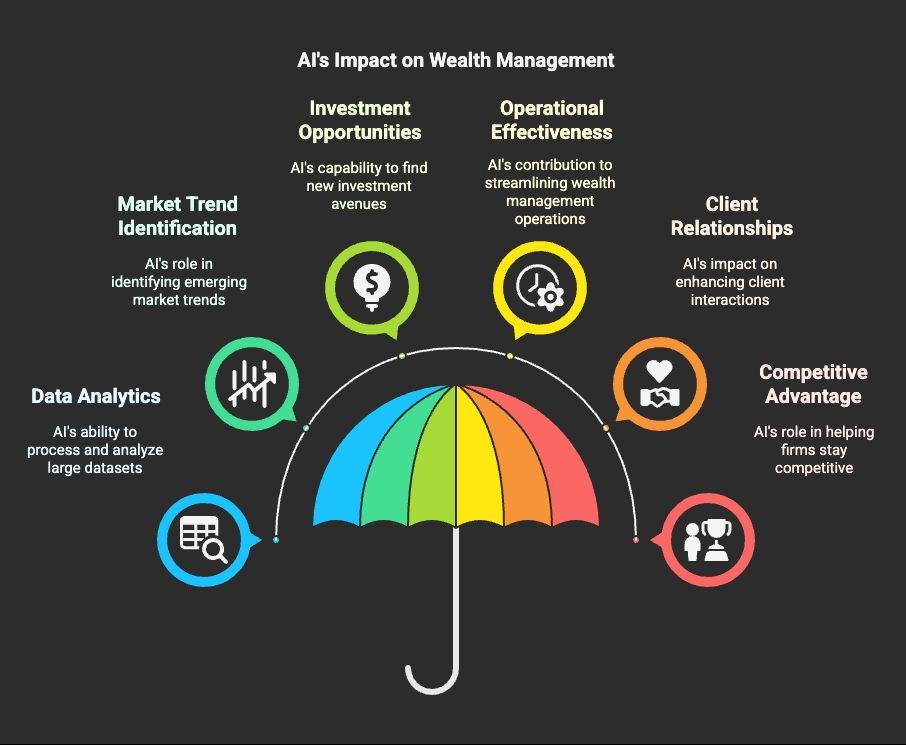

Key Benefits of AI and Automation in Wealth Management

- Enhanced Decision-Making: By leveraging AI-driven investment strategies, wealth managers can make more informed decisions based on real-time data analysis. This allows them to offer customized investment portfolios tailored to each client's risk tolerance and financial goals.

- Increased Efficiency: Automation simplifies repetitive tasks such as data entry, compliance checks, and client report generation. By utilizing tools like Robotic Process Automation (RPA) and machine learning, advisors can save valuable time to focus on high-value tasks, ultimately improving client satisfaction.

- Robust Risk Management: AI systems constantly monitor global financial markets, flagging unusual activities and potential fraud in real time. This proactive approach ensures greater protection for clients' assets, thus enhancing trust and security in financial dealings.

- Seamless Client Engagement: AI-powered chatbots and virtual assistants provide clients with 24/7 access to their accounts, answering inquiries, and offering personalized insights. This level of engagement keeps clients informed and involved in their financial journeys.

The Evolution of AI Technology in Wealth Management

AI's integration into wealth management has come a long way since its inception in the 1990s, evolving from basic data entry functions to sophisticated analytical platforms used widely today. A major shift occurred in the 2010s with the introduction of robo-advisors, which made basic investment advice accessible to a broader audience.

Today, AI-driven tools are capable of analyzing unstructured and structured data, predicting market trends, and helping advisors create tailored investment strategies that reflect both current market conditions and individual client needs.

The Future of AI in Financial Services

The integration of AI in wealth management is just the beginning. As advancements in technology continue to emerge, we can anticipate further improvements in customization and efficiency across the sector. Some critical areas to watch include:

- Predictive Analytics and Market Forecasting: AI will likely enhance its capabilities in forecasting market changes, allowing advisors to react swiftly to shifting economic conditions.

- Hyper-Personalization of Services: As data becomes more robust, firms will be able to offer even more tailored solutions based on clients’ behaviors and preferences.

- Regulatory Innovations: With growing scrutiny on AI deployments in finance, robust compliance mechanisms will have to be in place, ensuring that financial institutions operate ethically and transparently while adopting these technologies.

Explore Collaborations with SimplAI

Are you ready to redefine your wealth management operations with cutting-edge AI solutions? Join SimplAI today to unlock your potential for automation in financial services and improve your investment strategies significantly.

Conclusion

AI-driven automation is reshaping the landscape of wealth management, offering unprecedented opportunities for efficiency and personalization. As the industry continues to evolve, embracing these transformative technologies will be essential for firms looking to thrive in a competitive market.

How are you preparing your wealth management strategy for the future? Share your thoughts and insights with us!