Automating Policy Renewals and Claims Processing

In today's fast-paced insurance landscape, automation is no longer a luxury—it's a necessity. As the demands of customers evolve, insurance companies must leverage technology, specifically AI policy renewal automation and claims processing automation AI, to streamline processes that once took significant time and resources. This transformation enables insurers not only to enhance operational efficiency but also to improve customer satisfaction in an increasingly competitive market.

The Urgency of Automation in Insurance

Insurance renewals and claims processing are critical junctions in the customer experience. A staggering 42% of homeowners and only 31% of motorists automatically renew their policies—this leaves substantial opportunities ripe for disruption. Young adults, particularly those under 35, are more inclined to shop around for the best deals, underscoring the necessity for insurers to optimize their renewal processes.

The traditional manual renewal process is fraught with challenges: from cumbersome paperwork to tedious data entry. Insurers often struggle to meet customer expectations amidst regulatory requirements, leading to missed opportunities. However, insurance automation technology allows for a seamless transition from manual to automated workflows. By embracing AI-driven policy management systems, insurers can streamline renewals and claims processing, thus positioning themselves ahead of competitors.

Revolutionizing Policy Renewals with Automation

The Advantages of Integrating Automation

- Personalized Communication: Automation platforms enable insurers to send personalized renewal reminders, catering to individual customer preferences. These timely notifications improve customer engagement and increase the likelihood of renewal.

- Speed and Efficiency: Automated systems can swiftly generate accurate renewal notices and approval workflows. Machine learning in claims management ensures insurers can assess risk factors in real-time, streamlining the underwriting process dramatically.

- Enhanced Customer Experience: By simplifying the renewal process, insurers can offer customers a smoother, more transparent experience. No longer bogged down by tedious paperwork, policyholders can now manage their renewals with a few clicks.

- Risk Mitigation: Automation minimizes human error by eliminating manual data entry and verification needs, thus enhancing the accuracy of renewal terms. Insurers can rest assured that their communications are compliant with state regulations, reducing the risk of fines.

- Security and Compliance: With robust encryption measures in place, automated platforms prioritize data safety while assisting insurers in adhering to compliance standards.

Transforming Claims Processing with Claims Automation

Claims processing is another area where automation makes a significant impact. The traditional system—characterized by extensive paperwork and long waiting periods—often leads to customer dissatisfaction. By leveraging claims processing automation AI, companies can enhance their claim handling capabilities effectively.

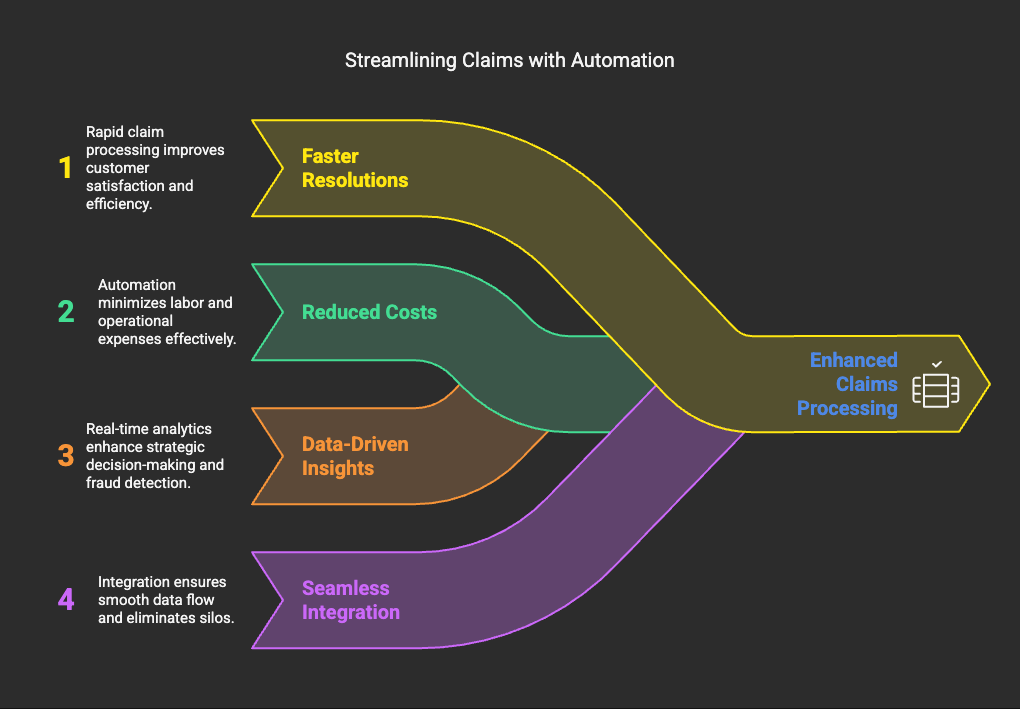

Key Benefits of Claims Automation

- Faster Claim Resolutions: Automation cuts down the time taken to process claims significantly, often reducing it by up to 75%. This leads to quicker payouts for policyholders and improved operational efficiency for insurers.

- Reduced Costs: By automating repetitive tasks, insurers can minimize labor costs and operational expenses. Advanced analytics help identify and eliminate process bottlenecks.

- Data-Driven Insights: Real-time data analytics provide insights into claims trends and performance, enabling insurers to strategize effectively. Automated systems can flag potentially fraudulent claims, ensuring fair treatment of all submissions.

- Seamless Integration: Automation solutions can integrate across existing systems, ensuring that information flows effortlessly and reduces the risk of data silos.

How SimplAI Provides the Solution

At SimplAI, we understand the struggle the insurance industry faces in managing complex processes efficiently. Our advanced and scalable solutions are designed to facilitate AI policy renewal automation and claims processing, transforming your business operations.

With our no-code platform, insurers can rapidly build high-accuracy Agentic AI apps that align with their unique workflows and needs. This not only simplifies policy management but also enhances collaboration across all departments.

Why Choose SimplAI?

- Rapid Deployment: Get systems up and running in no time.

- Compliant and Secure: Keep your customer data safe while meeting regulatory standards.

- User-Friendly: Our intuitive platform is designed for seamless user experiences, requiring minimal training.

Conclusion

The insurance industry is at a pivotal point where automation isn’t just beneficial—it's essential for future success. By incorporating automation into policy renewals and claims processes, insurers can improve efficiency, drive customer satisfaction, and maintain competitive advantages.

Are you ready to enhance your insurance operations through automation? Speak to our experts at SimplAI today and discover the transformative power of our solutions—because the future of insurance is automated!