AI-Powered Portfolio Management Strategies

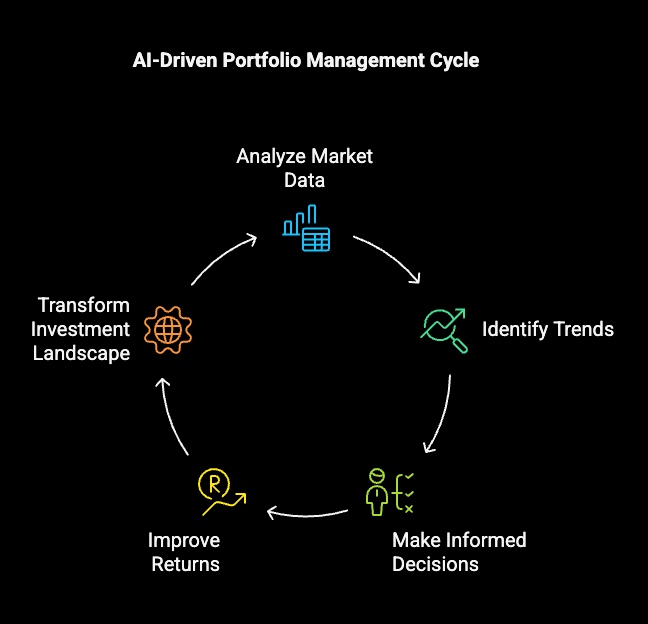

In an age where information overload is the norm, the financial services sector increasingly seeks ways to simplify and enhance decision-making. Enter the realm of AI portfolio management—where technology meets finance to transform traditional investment strategies into sophisticated, data-driven processes. As we advance toward 2025, the rising significance of AI in portfolio management is evident, underscoring the critical need for financial institutions to adapt in a competitive landscape.

The Shift from Traditional to AI-Driven Portfolio Management

Portfolio management is fundamentally about creating and managing investment portfolios to optimize risk and return based on an investor's financial goals. However, traditional methods often falter amid the complexities of fluctuating markets, leaving managers overwhelmed by data. With machine learning investment strategies and automated investment tools, AI enables a level of analytical insight and agility previously unattainable.

AI in portfolio management utilizes vast quantities of data—both structured and unstructured—to reveal patterns that drive better investment decisions. Through its ability to analyze market trends in real-time, AI can provide a level of predictive accuracy that empowers managers to navigate volatility adeptly. For instance, predictive analytics in investing can forecast market movements and suggest asset management actions before trends fully materialize.

Understanding AI's Role in Different Management Styles

- Aggressive Portfolio Management: AI algorithms identify undervalued assets and execute trades quickly to maximize profits in volatile markets. Portfolio managers can leverage machine learning models to catch windows of opportunity more effectively than ever.

- Conservative Portfolio Management: AI assists in selecting stable investments that yield consistent returns, giving users confidence in maintaining steady growth. By identifying low-risk assets, managers can build resilient portfolios less prone to market turbulence.

- Discretionary Portfolio Management: In this approach, AI enriches the decision-making process by tailoring recommendations to individual client goals and risk profiles. As market conditions evolve, AI continuously adjusts these recommendations, ensuring alignment.

- Advisory Portfolio Management: AI enhances the advisory role by delivering data-driven insights that empower investors to make informed decisions. With the analysis of extensive datasets, AI can suggest adjustments that align with an investor's evolving financial landscape.

AI-Powered Solutions for the BFSI Sector

For businesses in the Banking, Financial Services, and Insurance (BFSI) sector, integrating AI into portfolio management translates to significant advantages:

- Advanced Data Analysis: AI models process vast datasets to uncover patterns and trends that can influence investment strategies. This level of insight provides a distinct competitive edge in identifying profitable opportunities.

- Dynamic Asset Allocation: AI tools adjust asset mixing based on market conditions and individual investor profiles, allowing for rapid rebalancing and aligning investments with financial goals.

- Automated Risk Management: Leveraging machine learning, AI can assess multiple risk factors to recommend diversification strategies. This proactive approach helps in mitigating risks associated with market fluctuations.

Implementing AI for Portfolio Management

Adopting AI in financial practices is not just about technology but also about effective implementation. Here are some key considerations:

- Choosing the Right AI Portfolio System: Selecting a system that suits specific needs is crucial. Factors like transparency, risk management mechanisms, and customization options should be prioritized.

- Ensuring Data Security: With AI's reliance on vast amounts of data, robust cybersecurity measures must be in place to protect sensitive financial information.

- Maintaining Human Oversight: While AI can optimize processes, it is essential to retain human decision-making in strategic areas to enhance the quality and relevance of AI outputs.

How SimplAI Can Help

At SimplAI, we specialize in building high-accuracy, agentic AI applications tailored to the financial sector. Our solutions provide firms in the BFSI landscape with the tools to harness the full potential of AI for portfolio management.

Embrace the future of financial management with SimplAI. By enhancing your investment strategies with our innovative AI-powered solutions, you can maximize returns and minimize risks effectively.

Conclusion

The landscape of portfolio management is continuously evolving, driven by the advancements in AI technology. As financial markets grow more complex, tools that simplify and optimize decision-making will become indispensable. Adoption of AI portfolios is no longer a matter of choice but a necessity for those wishing to thrive in a competitive marketplace.

How is your organization preparing to adopt AI in portfolio management? Let us know in the comments!

Ready to transform your investment strategy? Explore SimplAI’s platform today to see how AI can revolutionize your approach to portfolio management.