AI-Powered Innovations in Insurance Services

The insurance sector is undergoing a transformation driven by advances in artificial intelligence (AI) and machine learning. As organizations recognize the need to adapt to changing customer expectations and an evolving risk landscape, AI in insurance is quickly becoming a catalyst for innovation and enhanced service delivery.

The emergence of insurtech innovations heralds a new era in which traditional models are being reshaped. In this blog, we will explore how AI-powered solutions are revolutionizing the insurance industry, showcasing key trends and speaking directly to the needs of industry professionals.

The Role of AI in Insurance

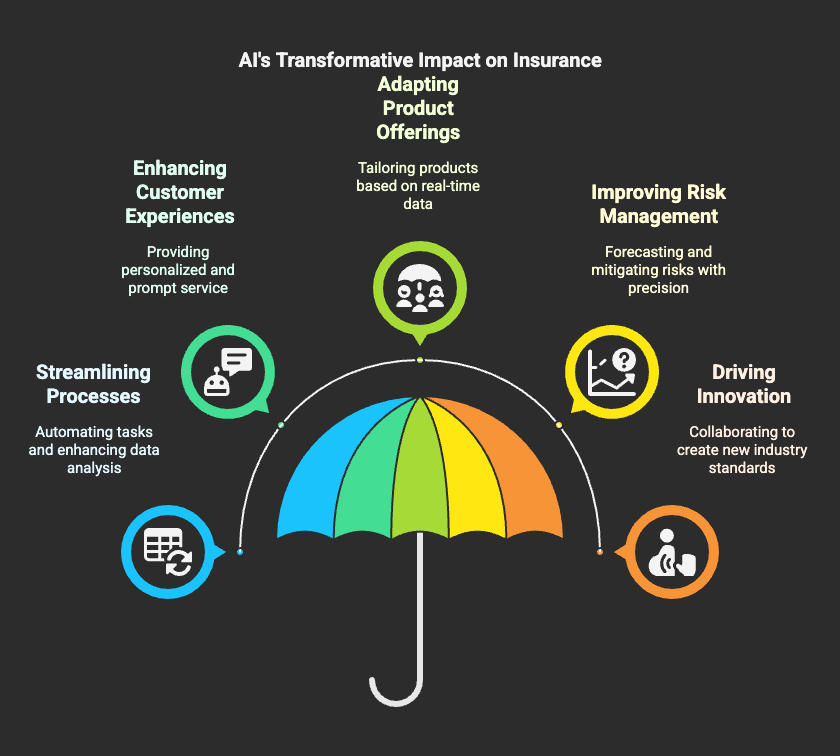

Artificial intelligence is enhancing operations across the insurance ecosystem. From improving underwriting accuracy to automating claims processing and personalizing customer interactions, AI is poised to tackle long-standing challenges in the industry. Here are some areas where AI is making an impact:

1. Streamlining Insurance Processes

One of the main challenges in the insurance industry has historically been managing vast amounts of data for underwriting and claims processes. AI-driven risk assessment tools analyze large datasets—drawing on information from public and private sources—to provide insurers with insights that enhance decision-making.

Moreover, machine learning in insurance allows companies to automate tedious tasks. By training algorithms on historical data, insurers can speed up the underwriting process and reduce fraud through anomaly detection. For instance, automating claims processing not only expedites settlements but minimizes human error, ultimately enhancing customer satisfaction (Source: KPMG).

2. Enhancing Customer Experiences

Today’s consumers expect swift responses and personalized service. AI-powered tools, such as chatbots and virtual assistants, can handle routine inquiries 24/7, ensuring that customers receive a prompt experience even outside business hours.

According to a PwC survey, 83% of business leaders in the insurance sector consider AI vital for their future strategy (Source: PW). Companies using AI report improved customer retention and loyalty due to their ability to meet these heightened expectations with tailored interactions.

3. Adapting Product Offerings with AI-Driven Insights

AI provides insurance companies with the agility to adapt products based on real-time market demands. Insurers can analyze behavioral data to personalize offerings, such as usage-based policies that adjust according to an individual's driving habits. This flexibility enhances customer satisfaction and enables companies to stay competitive in a crowded market space (Source: EY).

4. Improving Risk Management

Effective risk management is at the heart of insurance operations. AI-driven risk assessment tools allow for more precise evaluations based on diverse data sources, enabling insurers to forecast and mitigate potential risks. The ability to harness real-time data empowers insurance providers to refine their pricing strategies and strengthen underwriting accuracy.

5. Driving Innovation through Collaboration

The insurtech landscape is evolving rapidly, with partnerships between traditional insurers and technology firms becoming increasingly commonplace. This combination leverages innovative technologies to create offerings that were previously unimaginable. For example, platforms like Clearcover and Lemonade have harnessed AI to streamline operations and engage more efficiently with customers—setting a new industry standard (Source: Insurtech Insights).

SimplAI Solutions for the Future of Insurance

At SimplAI, we are committed to providing the fastest and simplest way to implement AI-powered insurance solutions. Our technologies integrate seamlessly with existing systems, ensuring you can leverage AI innovations without extensive overhauls.

Our focus on developing machine learning capabilities means your organization can benefit from more accurate risk assessments, automated document processing, and enhanced customer interactions. We simplify the complexities of implementation, allowing you to focus on what matters—serving your customers better.

Conclusion

As the insurance industry continues to embrace AI innovations, the opportunities for improvement are immense. From automating claims to personalizing services, companies that adopt these technologies will find themselves ahead of the curve.

Are you ready to explore AI-driven transformation further? Consider discovering how SimplAI can enhance your insurance operations today! Contact us for a demo or to learn more about our offerings.