Automated Mortgage Processing with SimplAI’s AI Agents

Automated mortgage processing refers to the use of intelligent systems—often powered by AI and multi-agent automation platforms like SimplAI—to streamline, accelerate, and improve the accuracy of the entire mortgage lifecycle. From document intake to underwriting and compliance, automation transforms manual, error-prone tasks into seamless digital workflows.

Direct Answer Box

Automated mortgage processing uses AI and intelligent agents to handle document classification, income verification, underwriting, and compliance—cutting loan processing times by up to 15 days and reducing manual errors.

Table of Contents

- Why Mortgage Processing Is Still Manual in 2025

- What Is Automated Mortgage Processing?

- Core Challenges in Traditional Mortgage Workflows

- How AI Agents Power Automated Mortgage Processing

- SimplAI’s Multi-Agent System in Action

- Real-World Results from SimplAI Clients

- Why Agentic AI Is the Future of Mortgage Tech

- Conclusion: The Path to Scalable, Intelligent Lending

Why Mortgage Processing Is Still Manual in 2025

Despite decades of digital transformation, mortgage processing remains one of the most fragmented and manual-intensive operations in financial services. A single loan application typically involves:

- Loan officers

- Credit analysts

- Underwriters

- Compliance teams

- Auditors

- Document processors

Each department operates using siloed systems with limited interoperability. As a result, most mortgage workflows are riddled with:

- Repetitive data entry from PDFs, Excel files, and portals

- Document overload with hundreds of pages per file

- Approval delays of 15–20 business days

- Error-prone handoffs and rework

- Compliance blind spots

- Static workflows that break with any exception

These inefficiencies lead to poor borrower experience, higher operational costs, and revenue leakage from missed deadlines.

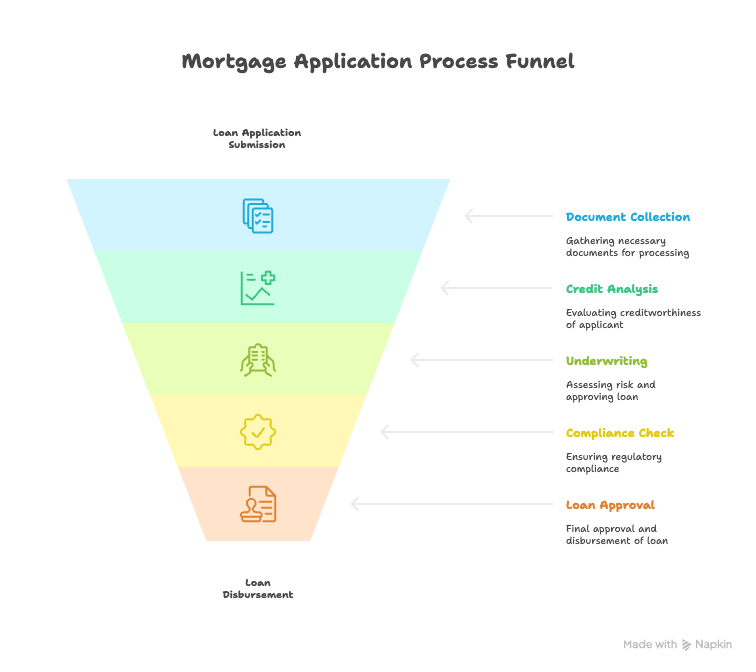

What Is Automated Mortgage Processing?

Automated mortgage processing is the use of intelligent systems—including AI agents, RPA bots, and machine learning—to digitize and orchestrate the entire lending workflow. Unlike rule-based automation or legacy mortgage origination software, modern AI platforms:

- Understand borrower documents

- Apply lender-specific policies

- Learn from exceptions

- Collaborate with human reviewers

More advanced implementations, like those by SimplAI, use agentic AI: a network of autonomous agents that specialize in different steps of the mortgage process and communicate with each other in real-time.

Core Challenges in Traditional Mortgage Workflows

| Challenge | Description |

|---|---|

| Manual Document Intake | Hundreds of pages per loan processed by hand |

| Repetitive Tasks | Copy-pasting borrower info across systems |

| Compliance Risk | Missing disclosures or outdated audit trails |

| Turnaround Times | 15–20 business days for approval |

| Limited Scalability | Adding volume requires more headcount |

| Siloed Systems | LOS, CRM, Credit, and Compliance tools don't talk to each other |

How AI Agents Power Automated Mortgage Processing

SimplAI replaces brittle automation scripts with intelligent agents that:

- Interpret unstructured documents

- Perform multi-step decision-making

- Escalate edge cases to humans

- Log every action with full traceability

Each AI agent mirrors a human team member, but operates 24/7, scales instantly, and never makes copy-paste errors.

Types of AI Agents in the Mortgage Workflow:

1. Document Intake Agent

- Classifies documents: e.g., bank statements, ID proofs, tax returns

- Extracts data fields with >99% accuracy

- Organizes documents in pre-configured structures

2. Pre-Check Agent

- Verifies borrower income, employment, and appraisal

- Cross-checks credit reports and ID proof

- Flags missing or outdated information

3. Underwriting Agent

- Applies DTI, LTV, and custom lending rules

- Flags risky borrower profiles or exceptions

- Maintains a digital underwriting trail

4. Compliance & Risk Agent

- Ensures TILA, RESPA, HMDA, and other regulations

- Auto-generates compliance reports

- Reduces audit penalties and regulatory delays

5. Coordinator Agent

- Assigns next steps to human agents

- Escalates exceptions with context

- Tracks file movement and SLAs

SimplAI’s Multi-Agent System in Action

SimplAI is purpose-built to support automated mortgage processing using a network of intelligent agents and secure integrations. Here’s how it works:

Step-by-Step Breakdown:

1. Submission Intake

Borrowers submit documents via web portals or email. The Document Intake Agent classifies and indexes all inputs.

2. Pre-Check Verification

SimplAI’s Pre-Check Agent instantly verifies income, employment, and credit history against internal and third-party systems.

3. Automated Underwriting

The Underwriter Agent applies lender-specific policies, generates an approval recommendation, and provides a full audit trail.

4. Compliance Review

Compliance Agent ensures all disclosures are sent and regulatory checks are met.

5. Task Routing

The Coordinator Agent ensures the file reaches the right person at the right time, escalating only when needed.

6. Final Review & Submission

The processed file can be sent to funding teams or regulators, with every step logged in SimplAI’s Observability Dashboard.

Real-World Results from SimplAI Clients

Mortgage lenders using SimplAI report:

| Impact Area | Result |

|---|---|

| Time Saved Per File | 12–15 days |

| Manual Tasks Eliminated | 20+ steps per loan |

| File Processing Time | Under 5 minutes avg. |

| Accuracy in Extraction | 95%+ verified |

| Compliance Risk | Reduced by 80% |

| Borrower Satisfaction | Significant improvement |

These benefits are not theoretical. They are seen across retail banks, NBFCs, and housing finance companies using SimplAI today.

Why Agentic AI Is the Future of Mortgage Tech

Most lenders have experimented with point solutions for OCR, eKYC, or underwriting. But these tools don’t talk to each other.

Agentic AI connects the entire value chain. Each agent is intelligent, autonomous, and collaborative.

Benefits include:

- Zero Marginal Cost at Scale

- Real-Time Exception Handling

- End-to-End Auditability

- Full LOS, CRM, and Core Integration

- BYOC or SimplAI Cloud Deployments

With SimplAI, lenders don’t need to rip and replace systems. Our APIs, SDKs, and mobile integrations allow seamless embedding into any workflow.

Conclusion

Automated mortgage processing using SimplAI eliminates manual bottlenecks across the entire lending lifecycle. It:

- Cuts loan processing time by up to 15 days

- Eliminates 20+ repetitive tasks per file

- Ensures compliance with built-in audit trails

- Improves borrower satisfaction and operational efficiency

This is not just automation. It’s agentic intelligence — scalable, secure, and built for the AI-native enterprise.

Call to Action

👉 See SimplAI in action with a personalized demo: https://simplai.ai/request-demo