Automating Compliance Checks in Financial Institutions

In the financial services sector, the landscape of compliance is constantly changing, fueled by a myriad of regulatory demands that require institutions to stay agile. As institutions grapple with complex requirements and the consequences of non-compliance, automating compliance checks has emerged as a vital tool for ensuring adherence. This blog will dive into the remarkable benefits of automated compliance and how AI compliance automation in finance can help streamline processes for financial institutions.

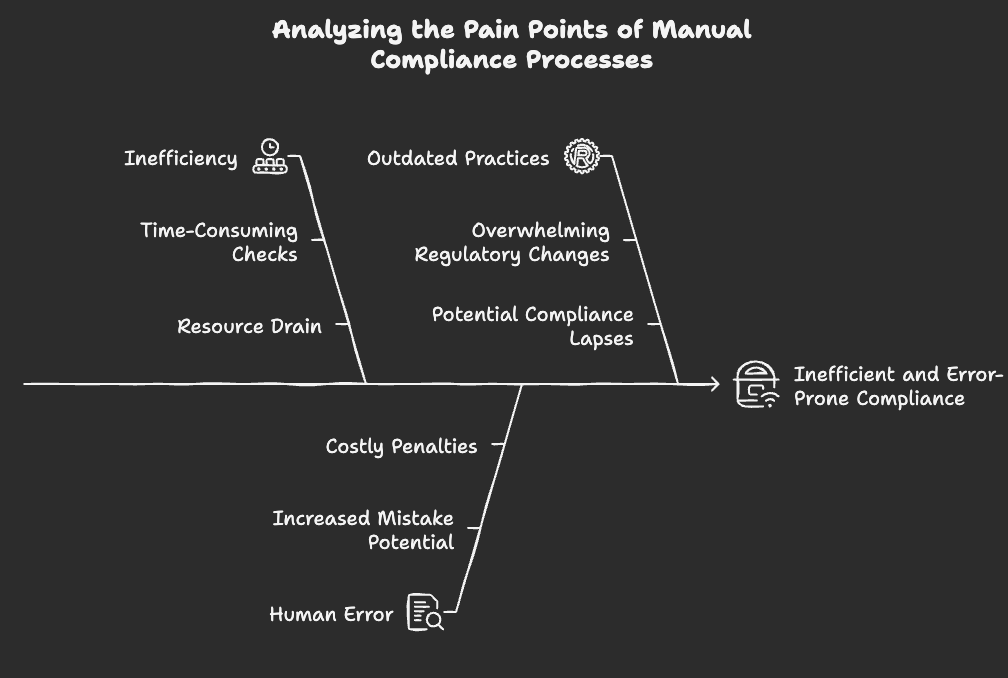

The Pain Points of Manual Compliance Processes

Organizations today face immense pressures from regulatory bodies. Tradition-bound manual processes can lead to a multitude of issues, including:

- Inefficiency: Manual compliance checks are time-consuming, often taking valuable resources away from core business functions.

- Human Error: Reliance on human resources increases the potential for mistakes, which can result in costly penalties.

- Outdated Practices: As regulations change frequently, keeping up with compliance can become overwhelming, leading to potential lapses.

By implementing automated regulatory compliance solutions, financial institutions can mitigate these challenges and position themselves for success.

Why Automate Compliance Checks?

1. Managing Growing Regulatory Complexity

Compliance regulations are becoming increasingly intricate. Financial institutions must navigate a myriad of requirements simultaneously. Automated systems not only help organizations manage complex regulatory landscapes more effectively but also keep them aligned with shifting standards.

2. Continuous Compliance Monitoring

Adhering to regulations is not a one-time task but an ongoing commitment. Automated compliance solutions enable continuous monitoring of organizational activities, ensuring that the institution remains compliant despite external changes.

3. Enhanced Reporting Capabilities

Automated platforms can streamline the reporting process by consolidating data and generating audit-ready reports in real-time. This means that financial institutions can present accurate compliance reports without diverting additional resources for manual data collection.

4. Increased Efficiency and Reduced Costs

Implementing financial institutions compliance technology can significantly reduce operational costs associated with compliance tasks. With automation handling repetitive tasks, compliance teams can focus on strategic initiatives that drive value for the organization.

5. Risk Management and Fraud Prevention

AI-driven compliance automation plays a crucial role in identifying and mitigating risks. Through sophisticated algorithms, these solutions can detect anomalies in financial transactions, thereby minimizing the chances of fraud.

Case Studies: Real Results from Automation

- Bancolombia: This leading Latin American bank implemented low-code technology to automate their SOX compliance processes, achieving a 59% increase in service efficiency and a 28% reduction in risk.

- A Major Bank in Eastern Europe: By integrating a centralized consent repository through automation, this institution strengthened its GDPR compliance while boosting operational efficiency by automating data from multiple systems.

- Stone Coast Fund Services: This hedge fund administrator has leveraged automation technology to ensure due diligence in large cash transfer processes, enhancing compliance before audits or investigations.

How SimplAI Can Help

At SimplAI, we provide intelligent automation in banking compliance, offering financial institutions the fastest and simplest way to implement AI-powered solutions. Our intuitive platforms help automate compliance checks seamlessly, ensuring your organization remains ahead of regulatory changes while enhancing operational efficiency.

Our Key Offerings:

- Real-time Monitoring: Keep up with dynamic regulations easily through our automated systems.

- Centralized Data Management: Access pertinent compliance information quickly from a unified interface.

- Customizable Solutions: Tailor our technology to address your institution’s unique compliance challenges.

Conclusion

Automating compliance checks is no longer just an option; it has become a necessity as regulations continue to evolve. AI compliance automation in finance enhances efficiency, reduces risk, and aligns financial institutions with regulatory standards seamlessly.

How equipped is your institution to handle the growing complexities of compliance? Share your thoughts or contact SimplAI to learn how our solutions can elevate your compliance efforts!