Creating AI-Powered Co-Pilots for Banking Operations

In the rapidly evolving landscape of financial services, the integration of Artificial Intelligence (AI) has emerged as a game-changing opportunity. Banks are increasingly seeking to enhance operational efficiency, improve customer experience, and streamline processes. One of the most promising advancements in this domain is the deployment of AI-powered co-pilots for banking operations.

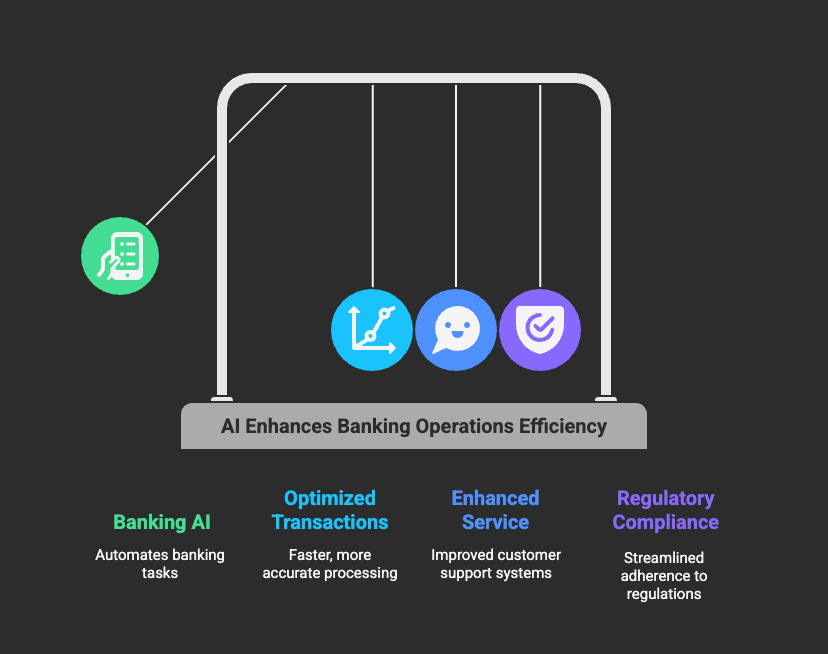

The Ripple Effect of AI in Banking Operations

The benefits of AI in banking operations extend beyond mere automation; they encompass enhancements in productivity and innovation. As banks have started to embrace co-pilot technology, they can optimize transaction processing, customer service, and regulatory compliance, thus paving the way for a more efficient and responsive banking environment. For instance, according to recent reports, companies implementing banking AI applications have realized significant improvements in accuracy and speed, reducing operational costs while enhancing service delivery.

What Are AI Co-Pilots?

An AI co-pilot is an intelligent system designed to work alongside bank employees, offering insights, automating repetitive tasks, and facilitating decision-making. It leverages large language models (LLMs) that can understand natural language to help users navigate systems more effectively.

Transforming Banking Operations with Co-Pilot Technology

Co-pilot technology for financial services is making significant strides by:

- Automating Repetitive Tasks: AI co-pilots can automate tasks such as data entry, transaction processing, and compliance checks, allowing employees to focus on higher-value work.

- Enhancing Decision-Making: By analyzing vast amounts of data in real-time, AI co-pilots provide actionable insights that empower finance professionals to make informed decisions swiftly.

- Personalizing Customer Interactions: These systems can curate custom responses based on a customer's past interactions, preferences, and transactional history, improving the overall customer experience.

- Streamlining Workflows: Co-pilot technology integrates with existing systems to simplify complex workflows, enhancing operational efficiency.

The Role of AI in Credit Management

In the realm of credit management, credit management AI solutions are crucial in evaluating risk, processing applications, and managing portfolios. AI co-pilots can quickly assess creditworthiness by analyzing an applicant's financial history and risk profile, enabling banks to expedite lending decisions without compromising accuracy.

Best Practices for Implementing Automated Banking Processes with AI

While the potential of AI co-pilots is vast, banks should approach implementation carefully:

- Define Clear Objectives: Outline what the desired outcome of integrating AI into your banking operations will be. It could be to improve customer service or enhance compliance.

- Pilot Projects: Initiate pilot projects with cross-functional teams to evaluate AI's impact on productivity and workflow efficiency.

- Invest in Training: Equip employees with AI literacy through training programs that detail how to effectively utilize these new tools.

- Evaluate Security and Compliance: Adhere to industry regulations and standards while implementing AI technologies, ensuring customer data remains secure.

Conclusion

The advent of AI-powered co-pilots in banking marks a significant advancement in how financial services operate. Through the effective use of automated banking processes with AI, banks can enhance productivity, improve customer satisfaction, and reduce operational costs.

Are you ready to embrace the future of banking with AI co-pilots? How do you envision implementing AI solutions to transform your banking operations?

Explore how SimplAI can revolutionize your banking experience today!