The Future of AI in Financial Services

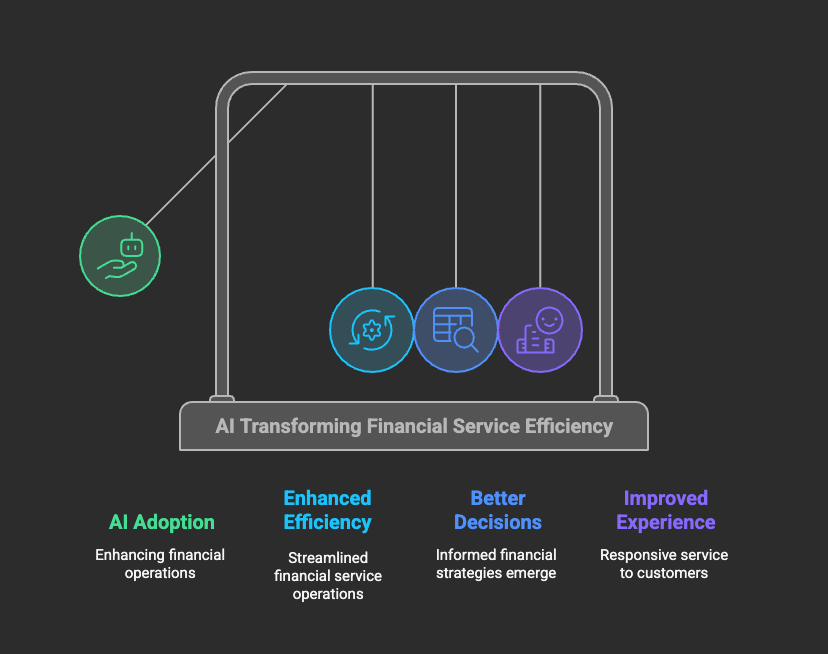

In recent years, AI in financial services has not only gained momentum but has also become a cornerstone of industry transformation. As financial institutions look towards the future, the integration of AI-driven financial solutions promises to streamline operations, enhance customer experiences, and drive significant revenue growth. With industry spending on AI expected to surge from $35 billion in 2023 to $97 billion by 2027—a compound annual growth rate of 29%—it's clear that the financial sector stands on the brink of an AI revolution (source: David Parker).

The Current Landscape of AI in Financial Services

Financial service providers are witnessing a landscape redefined by the use of advanced AI technologies. Major banks are deploying artificial intelligence credit management systems to enhance risk assessments, improve customer service, and automate routine tasks ranging from compliance checks to customer interactions. Such systems provide tangible advantages in operational speed, accuracy, and customer satisfaction.

A few noteworthy advancements include:

- AI Co-Pilots: These tools work alongside human employees, enhancing workflows and enabling significant productivity. For example, Citizens Bank estimates that with the help of generative AI, they can attain up to 20% efficiency gains (source: David Parker).

- AI Web Crawlers: Continuous data gathering allows financial institutions to stay ahead of market movements and consumer sentiment, thereby proactively managing risks.

- Hyper-Personalization: AI's capacity to leverage non-financial data is shifting banks towards tailored service offerings that anticipate customer needs—essentially moving from reactive to proactive engagement.

The Future of AI Technology in Financial Services

Looking ahead, the future of AI technology will undoubtedly leverage more sophisticated applications as infrastructure and regulatory frameworks mature. A notable aspect will be the reliance on synthetic data to enhance regulatory compliance and risk management. By simulating a variety of scenarios including market fluctuations and customer behavior, institutions will be able to make better-informed decisions—a vital capability in today's increasingly volatile landscape.

Additionally, the integration of financial technology trends such as blockchain and automation will complement AI initiatives, essentially creating a cohesive ecosystem that streamlines financial operations while ensuring security and compliance.

Potential Challenges Ahead

Despite the excitement surrounding these trends, challenges remain. The ethical dimensions of AI use, particularly regarding data privacy and algorithmic bias, must be navigated carefully. Financial institutions will need robust governance frameworks that ensure fairness and maintain customer trust. Furthermore, cultural resistance and the need for strategic alignment pose significant hurdles to effective AI implementation.

SimplAI's Solutions: Leading the Charge in AI-Driven Financial Services

At SimplAI, we understand the critical role AI plays in transforming financial services. Our platform is designed to facilitate effortless AI-driven financial solutions that enable financial institutions to harness the power of artificial intelligence fully. SimplAI offers a platform that is not only user-friendly but also scalable, allowing organizations to maintain compliance while optimizing processes.

Whether it's enhancing customer interactions through chatbots or streamlining compliance procedures with automated systems, we provide the architecture necessary for financial institutions to thrive in an AI-driven world.

Conclusion

As we stand at the forefront of this transformative era, AI is set to revolutionize every facet of the financial services industry. From enhancing operational efficiencies to unlocking new revenue streams through hyper-personalization, the potential is immense. The key will lie in how effectively financial institutions can adapt and integrate these advancements while ensuring ethical standards.

What changes are you considering to ensure your organization is ready for the future? Join the conversation and discover how SimplAI can support your journey towards leveraging AI in financial services. Explore our platform today to unlock the full potential of AI!