How AI is Revolutionizing the BFSI Industry

In today's fast-evolving world, artificial intelligence (AI) is not just an innovative tool, but rather a pivotal force transforming the Banking, Financial Services and Insurance (BFSI) industry. With significant pressure on institutions to enhance customer experiences, streamline processes, and bolster security, leveraging AI in the BFSI sector has become essential.

The Growing Impact of AI in BFSI

From autonomous chatbots enhancing customer service to sophisticated fraud detection algorithms, AI is reshaping how financial services operate. As highlighted in the 2024 Global AI Report, organizations utilizing machine learning banking solutions report a superior ability to adapt to customer needs and market fluctuations—setting them apart in a competitive landscape.

Personalized Services Through AI-driven Insights

AI technologies empower banks to analyze vast amounts of customer data effectively. By deploying advanced analytics, institutions can segment customers based on demographics, preferences, and behaviors, thereby providing tailored product recommendations. For instance, an AI model might identify a subset of younger customers gravitating towards digital banking, prompting the creation of targeted, innovative offerings.

This move towards personalized banking isn't just beneficial; it's crucial for maintaining a competitive edge in a rapidly changing market. The shift towards artificial intelligence credit management exemplifies how organizations can minimize risks while simultaneously improving customer acquisition.

Streamlining Processes for Efficiency and Security

AI doesn't just enhance customer interactions; it actively streamlines operational processes. Autonomous tooling, comprising software that operates with minimal human intervention, is becoming a vital asset in the BFSI landscape. Whether it's improving cybersecurity measures through automated monitoring or optimizing backend processes, these tools can significantly decrease costs and increase responsiveness.

Furthermore, AI in the BFSI sector aids in speeding up credit risk assessment, allowing institutions to make more informed lending decisions and reduce credit losses stemming from inaccurate evaluations. This operational resilience, supported by AI technology, is no longer a luxury but a fundamental need for organizations wishing to preserve customer trust.

Addressing Challenges with Smart AI Applications

Despite the transformative potential of AI, the journey hasn't been devoid of challenges. With the growing reliance on AI technology, BFSI organizations must ensure stringent data privacy measures and navigate the complex regulatory landscape. The risks inherent in credit assessments, fraud detection, and customer interactions raise valid concerns about ethical boundaries and potential biases in AI-driven systems.

The Importance of Ethical AI

To fully harness the capabilities of AI technology in credit risk assessment and other applications, banks need robust governance frameworks. Institutions must prioritize transparency within AI algorithms to instill customer confidence and maintain compliance with regulatory standards. AI must work as a bridge to foster trust, rather than creating more hurdles.

The SimplAI Solution

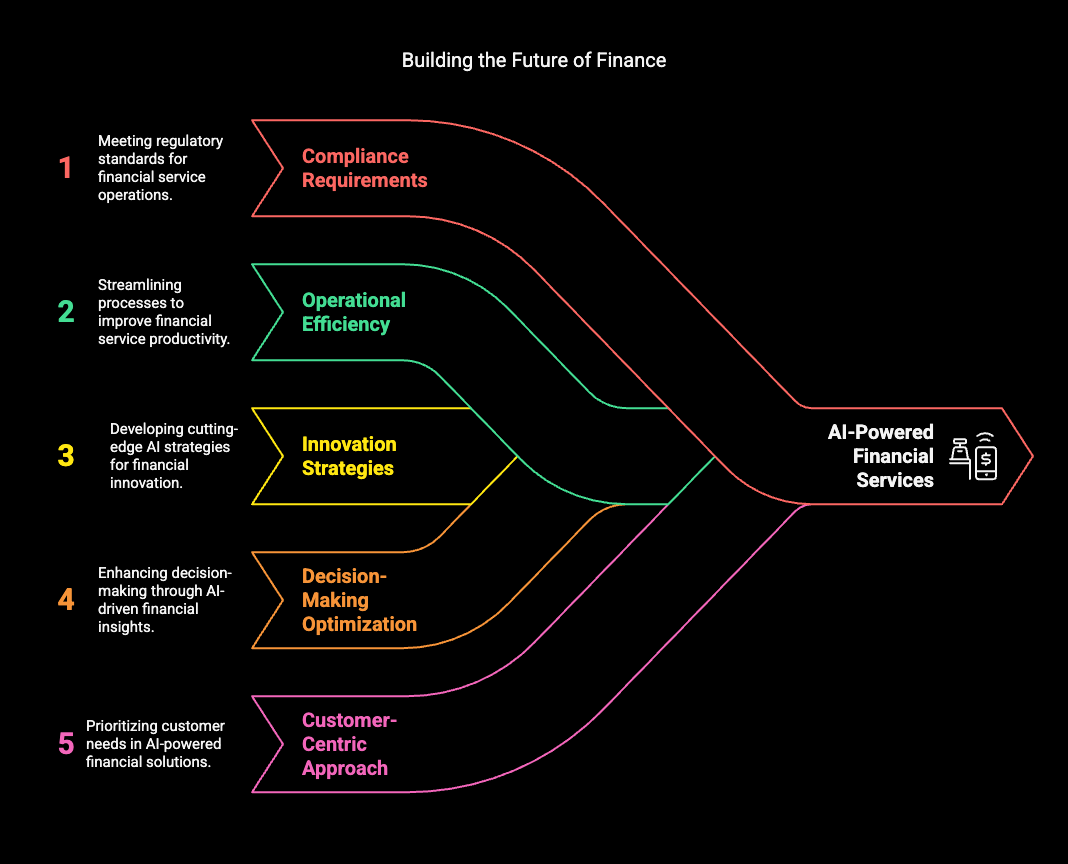

At SimplAI, we understand the multifaceted challenges that financial institutions face today. Our solution offers the fastest and simplest way to implement AI-powered financial services that not only meet compliance requirements but also enhance operational efficiency. With our expertise, organizations can develop AI strategies that drive innovation, optimize decision-making processes, and ultimately put customers first.

Transforming Tomorrow's Banking Landscape

As we look ahead, the BFSI sector's integration of AI holds promising potential. Institutions that prioritize adopting AI-driven insights to bolster operational resiliency will not only enhance their immediate capabilities but also secure their long-term sustainability in the market.

Conclusion

The journey of integrating AI in the BFSI sector is an ongoing one, marked by significant advancements and emerging trends. As AI continues to evolve, financial institutions must proactively engage with its transformative potential to remain competitive and customer-centric. So, how are you planning to implement AI in your organization’s strategy?

For more insights on implementing AI solutions that drive success, explore what SimplAI has to offer. Let’s transform banking together!