Introducing the SimplAI Credit Analyst AI Agent

Revolutionizing Corporate Credit and Lending Operations

In the fast-paced world of corporate credit and lending, efficiency and accuracy are paramount. The SimplAI Credit Analyst AI Agent is here to transform how credit organizations operate. Powered by SimplAI's agentic AI framework, our intelligent agent acts as a trusted assistant, empowering credit managers to make faster, more informed decisions while reducing operational overhead.

Whether you’re extracting critical insights from financial documents or generating tailored credit proposals, the SimplAI Credit Analyst AI Agent is designed to enhance productivity, minimize errors, and scale your operations effortlessly.

When exploring the agent in the experience center, you’ll witness some of its key functionalities in action. However, the full capabilities of this transformative solution go far beyond what can be showcased in a single interaction. This blog provides a comprehensive overview of how the agent revolutionizes your workflows and empowers your team to excel.

Empowers Credit Managers to Operate Beyond Human Limits

1. Instant Insights Retrieval

- Upload financial documents such as statements, annual reports, and management accounts.

- Extract key information with page-level insights for a granular understanding of critical data.

- Make data-driven decisions faster than ever before.

2. Automated Credit Analysis

Automate critical analyses with ease:

- Spread Analysis: Simplify trend evaluation and variance detection.

- Covenant Testing: Ensure compliance with loan agreements seamlessly.

- Risk Assessment: Mitigate potential risks with precision and ease.

- Ratio Calculations: Automate calculations to evaluate creditworthiness effectively.

3. Tailored Credit Proposals

- Automatically generate detailed, customized credit proposals that meet your organizational requirements.

- Leverage extracted document insights to ensure your proposals are accurate and comprehensive.

- Eliminate the repetitive effort of manual drafting, ensuring consistency and accuracy every time.

Why It Matters: The Business Impact

Unlock New Levels of Productivity

- Save over 25+ hours per week by automating tedious tasks like data retrieval and financial analysis.

Faster, Smarter Decision-Making

- Complete credit assessments 96% faster, speeding up approval timelines and enhancing customer satisfaction.

Enhanced Accuracy

- Reduce errors by extracting and analyzing financial data with 95% accuracy, ensuring reliable outcomes.

Scalable Operations

- Handle up to 10x more credit proposals, empowering your team to achieve more without additional resources.

Cost Efficiency

- Free up analysts to focus on strategic initiatives, such as building client relationships and negotiating contracts.

How the Technology Works

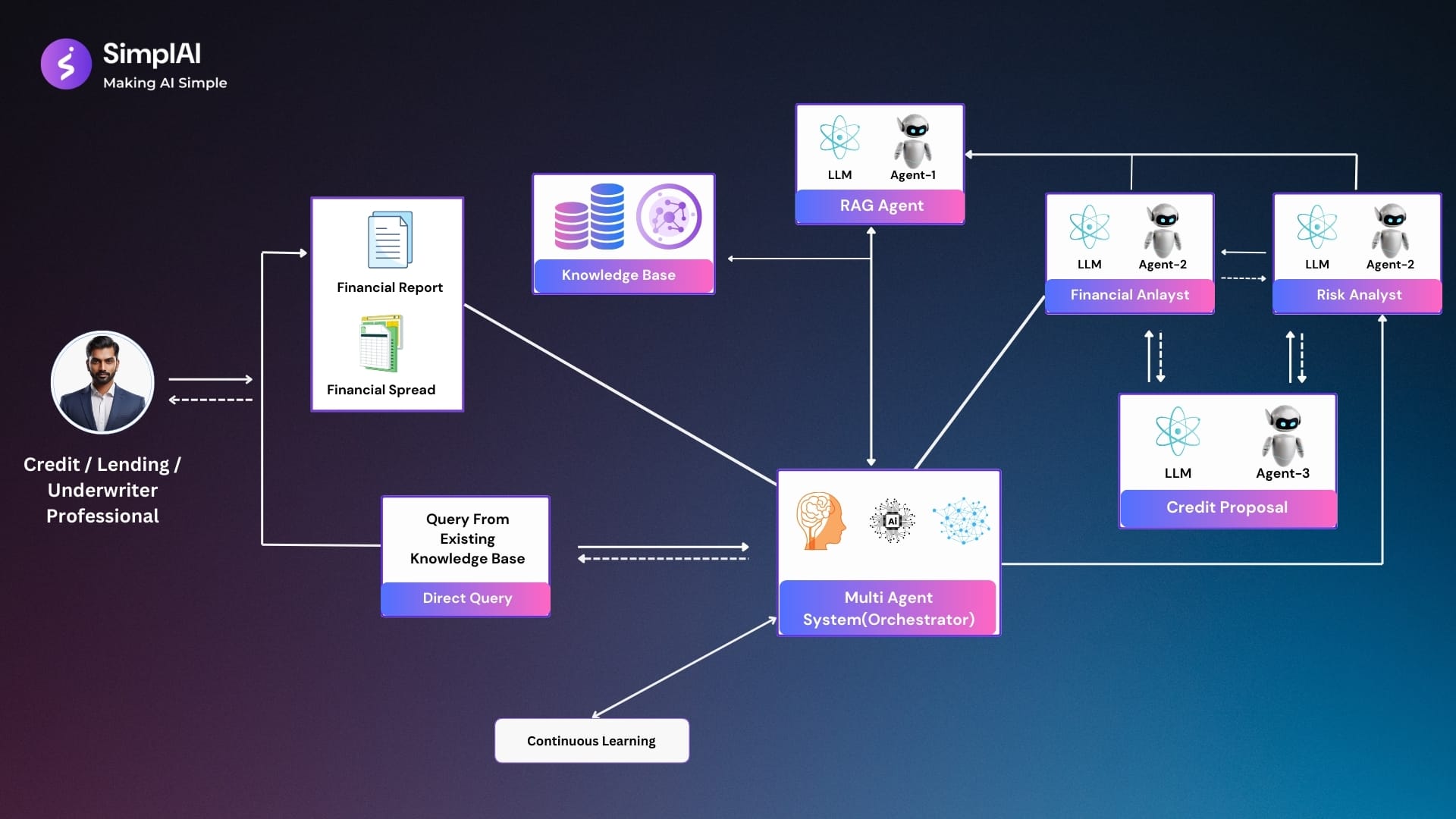

Multi-Agentic Architecture

- Built with specialized agents for tasks like financial spreading, report analysis, and investment evaluation.

Seamless Integration

- Integrates effortlessly with your existing credit management systems, enabling a smooth transition.

Flexible Deployment Options

- Deployable on any cloud or on-premise infrastructure to meet your organizational needs.

Enterprise-Grade Security

- Designed with enterprise-grade security to protect sensitive financial data.

Customizable Workflows

- Adaptable to your organizational processes, workflows, and specific credit evaluation criteria.

What You Experience in the Experience Center

During your interaction with the SimplAI Credit Analyst AI Agent in the experience center, you’ll experience some of its core capabilities, such as:

- Extracting insights from financial documents.

- Performing automated credit analyses.

However, this is just a snapshot of its potential. The agent’s full capabilities allow for end-to-end automation of credit workflows, from retrieving insights to generating comprehensive credit proposals, and scaling your operations to handle higher volumes effortlessly.

Explore the Full Potential

The SimplAI Credit Analyst AI Agent is more than a demonstration—it’s a game-changer for credit organizations. With the ability to save 25+ hours per week, deliver credit assessments 96% faster, and scale operations by 10x, this agent redefines what’s possible in corporate credit and lending.

Book a Demo Today to explore how SimplAI can revolutionize your credit processes beyond the experience center.

For additional details, reach out to Sandeep Dinodiya, and discover how SimplAI can be the catalyst for your credit transformation.