Navigating Compliance Challenges in Credit Management with Agentic AI

In today's fast-paced financial landscape, the complexities of compliance in credit management have escalated, challenging banking institutions and financial organizations to adapt swiftly. With a growing need to navigate regulatory requirements, managing compliance while ensuring efficiency has never been more crucial. Enter Agentic AI—a transformative technology that can significantly enhance compliance efforts in credit management, offering solutions that blend cutting-edge technology with robust governance.

The Need for Enhanced Compliance in Credit Management

As businesses across the financial services and banking sectors face increasing pressure from regulators, non-compliance can lead to substantial fines and reputational harm. According to a recent IDC report, over 40% of Global 2000 organizations are expected to adopt AI agents for complex processes by 2027. This rapid expansion underscores an urgency for compliance strategies that integrate technology intelligently.

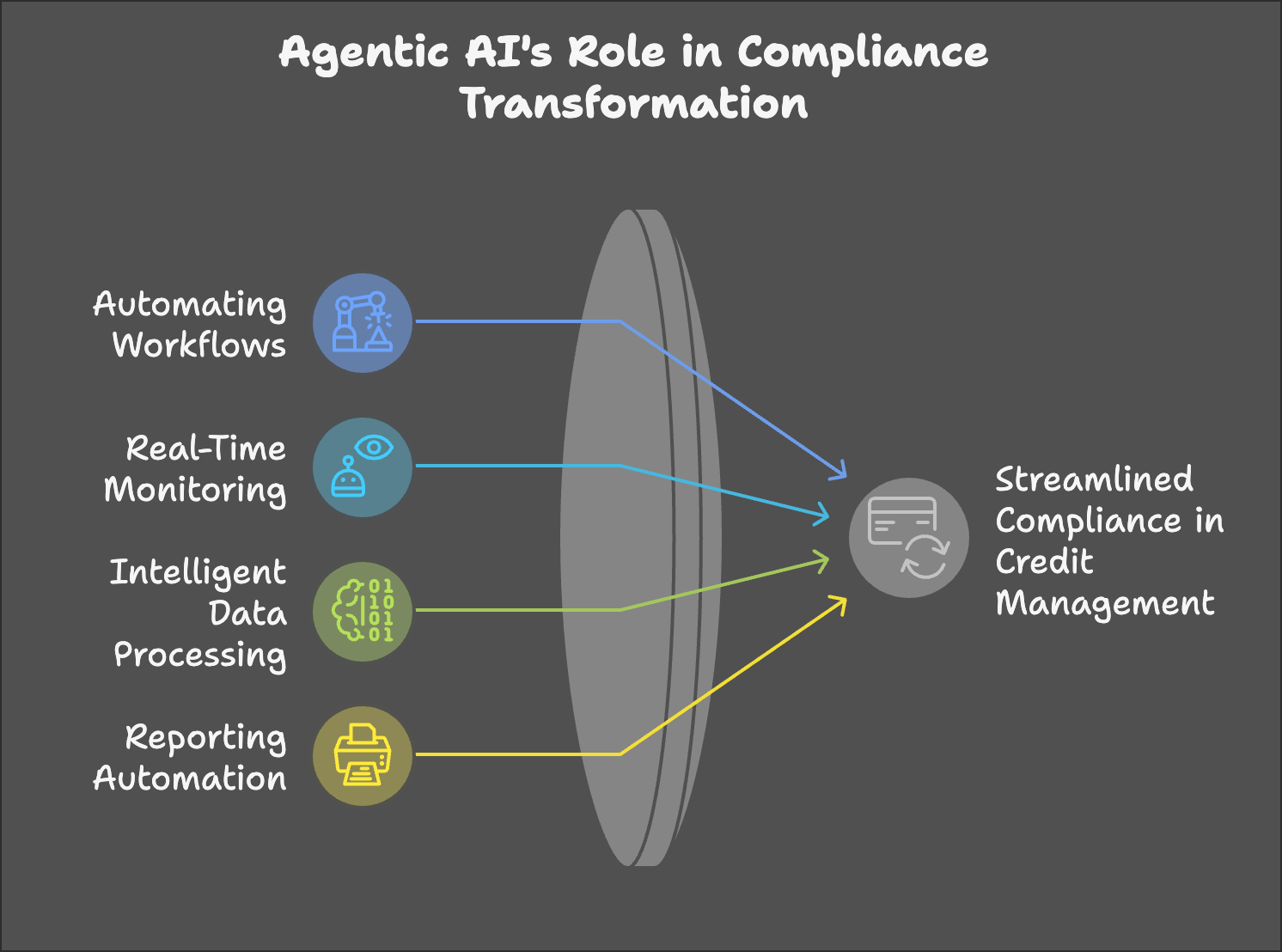

How Agentic AI Transforms Compliance in Credit Management

Agentic AI offers a revolutionary approach to addressing compliance challenges. Unlike traditional AI models, Agentic AI can operate autonomously, adapting to changing environments and managing complex tasks without constant human oversight. Here’s how it can help streamline compliance efforts in credit management:

1. Automating Compliance Workflows

Agentic AI can break down and automate the labor-intensive processes involved in compliance, from document verification to transaction monitoring. Consider an AI agent that can autonomously analyze new regulatory requirements and map out the necessary internal processes to ensure adherence. This adaptability ensures that compliance measures are not just reactive but also anticipatory.

2. Real-Time Monitoring and Assessment

By implementing AI in BFSI compliance, financial institutions can maintain dynamic oversight of their operations. Continuous monitoring helps identify compliance breaches as they arise and suggests corrective actions swiftly. This proactive approach minimizes potential fines and losses associated with regulatory errors.

3. Intelligent Data Processing

Credit management solutions powered by Agentic AI can process vast amounts of data efficiently. AI-driven algorithms can assess not just traditional data sources—like credit scores—but also consider alternative factors such as transaction history and behavioural patterns. This holistic evaluation leads to more accurate creditworthiness assessments.

4. Reporting and Documentation

Agentic AI simplifies compliance reporting by automating the generation of reports that adhere to regulatory standards. Such automation ensures that reports are timely and reflective of real-time data, which is crucial for effective decision-making.

Challenges and Considerations in Integrating AI for Compliance

While the advantages of Agentic AI are substantial, implementing this technology in credit management is not without its challenges:

1. Managing Data Privacy

Agentic AI systems require significant data access to function effectively. Organizations must ensure compliance with laws such as the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA), proactively managing consent and data exposure.

2. Addressing Bias and Transparency

AI systems are not immune to bias, particularly if the data they are trained on is flawed or incomplete. Organizations must prioritize fairness and transparency in the algorithmic decision-making process.

3. Establishing Robust Governance

Building a trustworthy AI framework necessitates comprehensive oversight mechanisms, including cross-functional governance teams responsible for monitoring AI processes and outcomes continually.

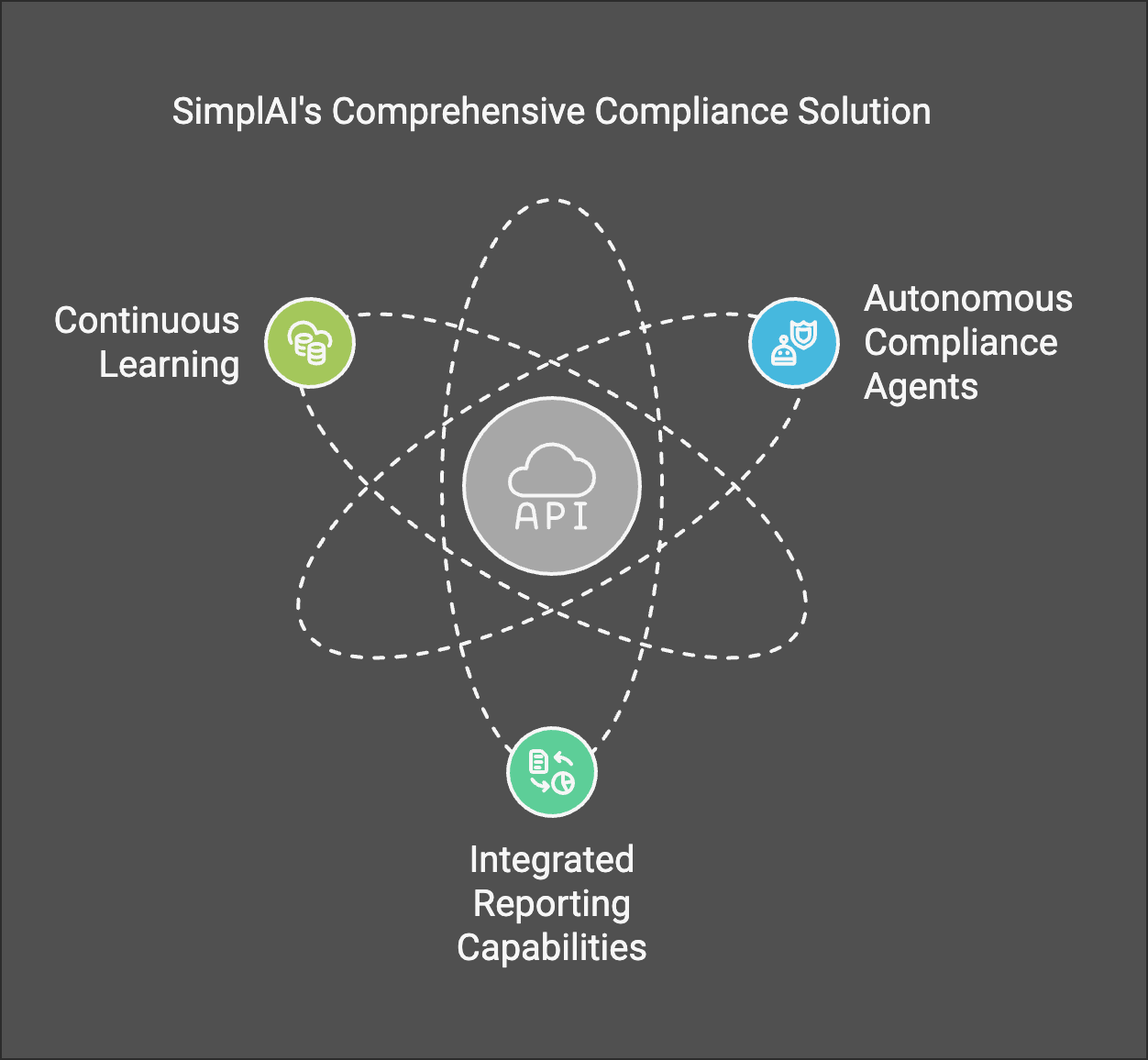

SimplAI’s Solution to Compliance Challenges

At SimplAI, we understand the challenges financial institutions face in compliance and credit management. Our Agentic AI credit compliance solutions are designed to enhance operational efficiency while ensuring that organizations remain compliant with regulatory requirements. From automating tedious manual processes to providing real-time insights into compliance standing, our platform empowers credit managers to focus on strategic decision-making.

Conclusion

As financial institutions embrace Agentic AI in navigating compliance challenges, it is imperative to consider the associated risks while harnessing its potential benefits. By integrating robust governance frameworks, organizations can enhance their credit management strategies, ensuring compliance with regulations while maximizing operational efficiency.

How prepared is your organization to implement AI-driven credit solutions?

For institutions looking to revolutionize their credit management processes, booking a demo with SimplAI could be your first step toward a smarter, more efficient future. Explore how we can help tailor our innovative solutions to your needs today!