Leveraging Pre-Built Connectors for Financial Data Analysis

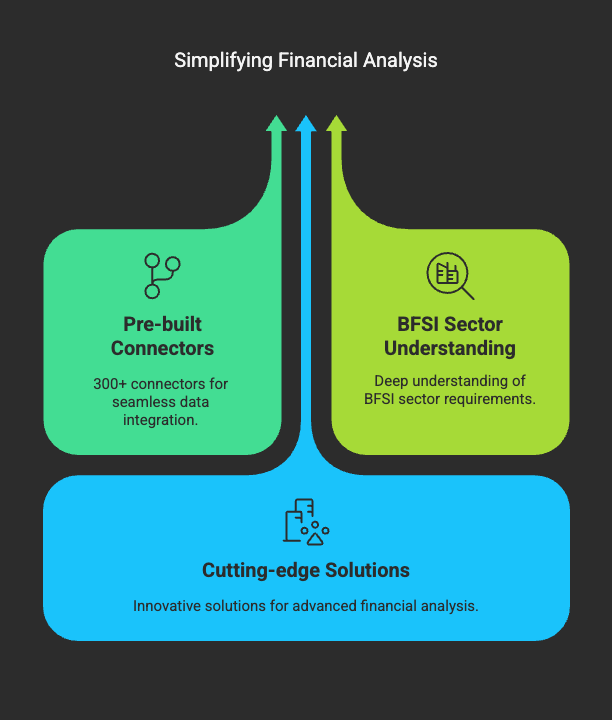

In today's fast-paced financial landscape, the need for accurate data analysis is more critical than ever. Businesses in the Banking, Financial Services, and Insurance (BFSI) sectors face an overwhelming architecture of data silos, which complicates real-time decision-making. SimplAI knows that to navigate these complexities, financial entities can significantly benefit from pre-built 300+ connectors for financial data analysis. These connectors seamlessly integrate diverse data sources, enabling organizations to harness the power of AI financial data analysis effectively.

The Growing Need for Data Integration in Finance

As financial institutions rely heavily on data to gauge performance and strategize for the future, traditional methodologies often fall short. The challenge lies in data integration in finance, where multiple, disparate systems exist. Manual processes not only consume valuable time but are also prone to error. With pre-built connectors, the ability to compile data—from transactional systems to ERPs—becomes simple and efficient.

Consider the scenario where finance teams need consistent access to essential indicators such as liquidity ratios or profitability metrics. With automated credit management tools powered by pre-built connectors, reporting transforms from a burdensome monthly exercise into a real-time analytical process. Teams can swiftly generate insights into financial analytics with AI, driving informed decision-making.

Advantages of Leveraging Pre-Built Connectors

- Cost-Effective: Building custom data connectors can be resource-intensive, requiring development expertise and ongoing maintenance. In contrast, pre-built connectors streamline the process, diminishing development costs significantly. Organizations can focus their resources on strategic initiatives rather than on habitual upkeep.

- Speed and Efficiency: The plug-and-play nature of pre-built connectors allows for rapid data integration. Businesses can set up connections in minutes, resulting in faster deployment and improved workflow. Real-time data access ensures that teams aren’t held back by data lag, leading to enhanced operational efficiency.

- Scalability: As businesses evolve, their data needs also expand. Pre-built connectors facilitate effortless scalability, allowing organizations to add or remove data sources rapidly based on operational demands. This agility keeps businesses competitive in a constantly changing market.

- Ease of Use: With the often complex landscape of data management, having user-friendly interfaces reduces the barriers for teams lacking technical expertise. Employees can focus on their core competencies rather than navigating complicated technical processes.

- Data Quality and Governance: Pre-built connectors help maintain data quality by providing consistent updates and compliance with governance standards. With reliable data, financial institutions can trust the accuracy of their analyses and reports, allowing for more robust financial oversight.

Real-World Applications of Pre-Built Connectors in Finance

By employing pre-built connectors, various organizations have realized notable success:

- CRM Integration: Financial institutions often utilize platforms like Salesforce for customer data management. Pre-built connectors can synchronize CRM data in real-time, offering teams accurate insights into customer interactions and creditworthiness.

- ERP Connectivity: Tools supporting ERPs like SAP or Oracle can seamlessly integrate via pre-built connectors, enabling finance teams to prioritize spending based on accurate operational data.

- Complex Analytics: With tools like BI and analytics platforms integrated through pre-built connectors, organizations can automate complex financial reporting without manual intervention, enhancing overall accuracy and reliability.

Conclusion

In an era where data is king, leveraging 300+ pre-built connectors for financial data analysis is no longer a luxury but a necessity. The benefits—cost-effectiveness, speed, scalability, ease of use, and robust governance—are compelling reasons for organizations in the BFSI space to invest in these solutions.

As you explore strategies to improve your financial analytics capabilities, consider: How can pre-built connectors change the landscape of your financial data analysis?

At SimplAI, we are here to help you navigate this transition.