Preparing for the Next Wave of AI in BFSI

The banking, financial services, and insurance (BFSI) sector is on the cusp of a monumental shift, driven by the evolution of artificial intelligence (AI). AI in BFSI is no longer a futuristic concept; it is a present-day imperative that financial institutions must harness to enhance operational efficiency, improve customer experiences, and maintain competitiveness. The recent advancements in financial services artificial intelligence, particularly in credit management AI and machine learning in credit risk assessment, are pivotal.

As we consider the future, the question is not whether AI will transform the banking landscape, but how quickly institutions can adapt to these upcoming changes and leverage AI's potential.

The Current State of AI in BFSI

AI has already left an indelible mark on the BFSI sector by enhancing various operational aspects and processes. According to experts, AI is projected to save the banking industry approximately $1 trillion by 2030, and $447 billion by 2023 (Business Insider). However, with these promising financial projections, there are also challenges, including cybersecurity risks and data privacy concerns that institutions will need to navigate.

AI Trends in Banking

Several key trends are emerging as AI continues to gain traction in the banking sector:

- Advanced Risk Management: AI systems analyze vast quantities of data swiftly, identifying potential risks and predicting future outcomes. This is vital, especially in a landscape where financial fraud costs the global economy billions annually.

- Credit Management: AI credit assessment tools are helping financial institutions make better credit decisions by analyzing both historical and predictive data. This allows lenders to mitigate risks, while also giving previously underserved populations access to financing options.

- Enhanced Customer Experiences: AI is at the forefront of personalizing banking services. Financial institutions are beginning to implement AI chatbots and virtual assistants to provide real-time customer support, a significant enhancement that improves client engagement.

- Operational Efficiency: AI-driven automation tools are being utilized to streamline back-office operations, thereby reducing staffing costs and improving the speed of service delivery.

- Regulatory Compliance: AI tools simplify compliance processes, allowing organizations to meet regulatory demands while minimizing human error. This is essential in a sector as tightly regulated as finance.

Opportunities and Challenges Ahead

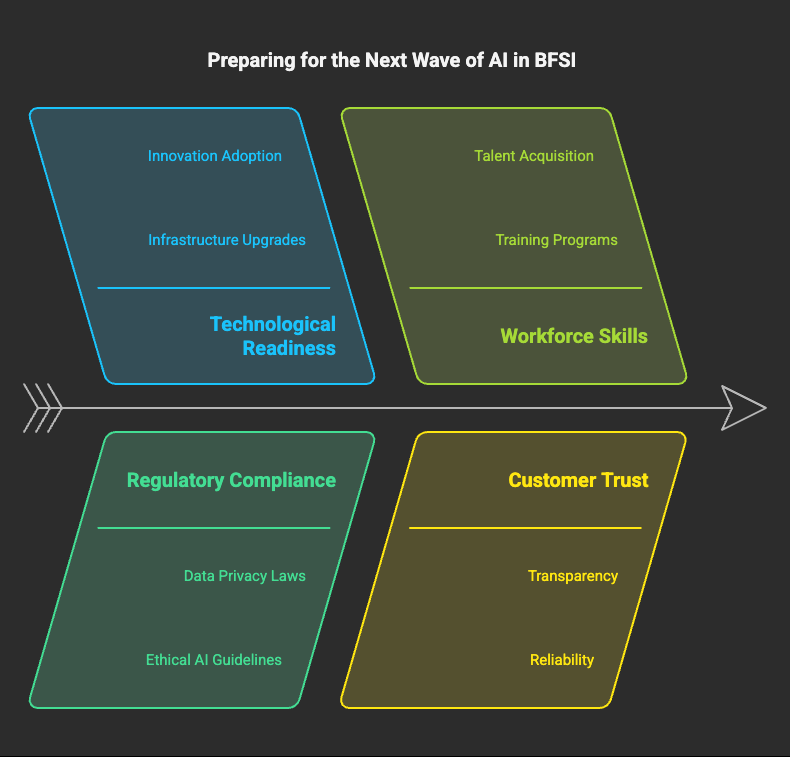

As banks prepare for the next wave of AI in BFSI, there are significant opportunities to be leveraged. The integration of AI-driven technology enables institutions to redefine traditional banking practices, enhance customer trust, and maintain competitive advantages. However, the transition will not be without challenges.

Key Challenges:

- Data Privacy and Security: With the advent of AI, banks face heightened scrutiny regarding customer data management.

- Legacy Systems: Many banks are still operating on outdated technology, which can inhibit the implementation of effective AI solutions.

- Workforce Reskilling: To fully realize the potential benefits of AI, financial institutions must invest in training employees to utilize these technologies efficiently.

SimplAI’s Role in Navigating the Future

At SimplAI, we provide the fastest and simplest way to implement AI-powered agents tailored specifically for the BFSI sector. Our solutions are designed to enhance functionality around credit management AI while ensuring compliance with regulatory frameworks. By offering advanced tools and automation, we empower financial institutions to streamline their processes while maintaining a strong focus on customer satisfaction.

Our AI-powered solutions not only address immediate operational challenges but also lay the groundwork for sustainable growth by anticipating market shifts and customer needs.

Conclusion

As we stand on the brink of a new era in banking, it is crucial for BFSI leaders to accelerate their AI adoption strategies. Institutions that effectively leverage AI will enhance service delivery and operational efficiency, while also meeting the progressive demands of modern consumers.

Are you ready to embrace the transformative potential of AI in your organization? Join SimplAI in leading the charge into the future of the BFSI sector with innovative solutions that not only enhance productivity but also foster customer trust and loyalty.

Reach out to us to explore how our AI-driven solutions can equip your institution to thrive in the rapidly changing financial landscape.