Real-Time Risk Assessment in Financial Transactions

In today's dynamic market landscape, financial institutions face an immense challenge in managing risks. The volatility of financial markets requires organizations to transition from traditional retrospective risk management to a more proactive approach: real-time risk assessment in finance. This shift is crucial for ensuring financial transactions are secure, regulatory compliant, and capable of withstanding market fluctuations. In this blog, we will explore how sophisticated technologies like AI and machine learning are revolutionizing risk assessment, enabling financial institutions to stay ahead of emerging threats.

The Importance of Real-Time Risk Assessment

Real-time risk assessment enables financial institutions to monitor and evaluate trading positions, market exposures, and potential financial losses continuously. Unlike conventional methods that rely on historical data and are often delayed, real-time risk monitoring allows for immediate detection and response to risky transactions. The stakes are high: delays in identifying a fraudulent transaction or credit risk could lead to substantial financial losses or regulatory penalties.

According to industry data, financial transaction monitoring with AI can reduce processing time by 80% and significantly enhance the detection capability for financial fraud. As financial landscapes become increasingly complex, leveraging machine learning in risk evaluation is no longer just an option—it's a necessity.

The Real-Time Challenges in Financial Services

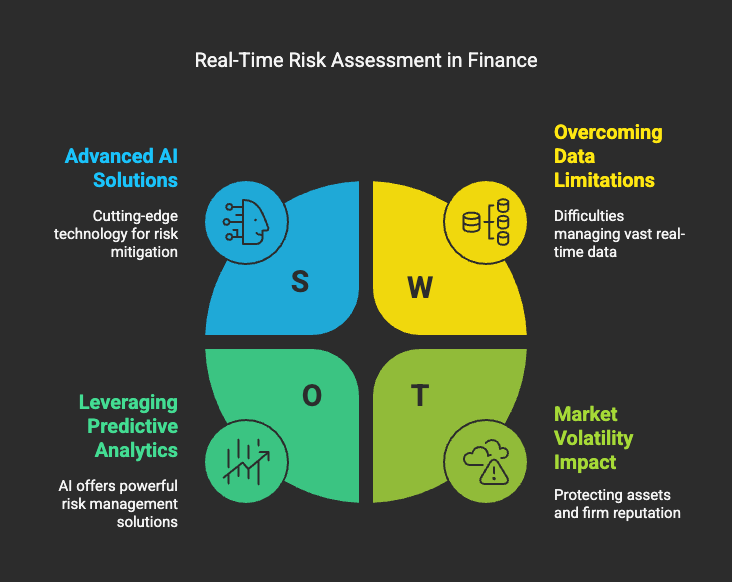

While the need for real-time risk management is clear, various challenges persist, including:

- Data Limitations: Traditional risk management tools face difficulties managing vast amounts of data collected from various sources in real time. This lack of comprehensive data can lead to inaccurate assessments.

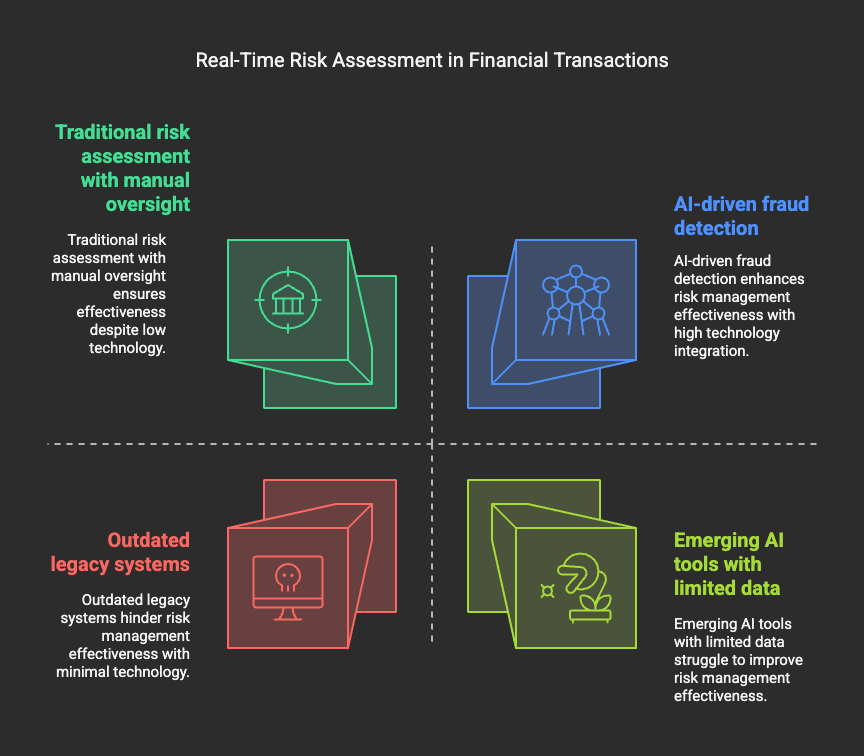

- Legacy Systems: Many organizations still rely on outdated technologies which cannot process real-time data efficiently, impacting scalability and risk responsiveness.

- Compliance Requirements: Financial institutions navigate a complex web of regulations. Real-time strategies must ensure compliance while maintaining fast operation.

Leveraging AI and Predictive Analytics

Predictive analytics in credit assessment and AI-driven methodologies offer a powerful solution to the limitations of traditional risk management techniques. Financial institutions can harness AI to identify patterns that indicate potential risks, such as:

- Unusual spikes in transaction volume.

- Anomalies in customer behavior based on historical data.

- External economic indicators that may signal future risks.

The integration of AI credit risk management can help institutions automate the underwriting process, ensure compliance with regulations, and utilize detailed analytics to predict risks before they occur.

Case Study: Implementation of AI in Risk Management

Imagine a financial institution receiving a large international wire transfer from a dormant account late at night. In the past, such transactions might have been flagged only after the fact, potentially resulting in significant losses. However, with real-time analytics for risk management in banking, the AI system can immediately analyze the transaction, assess risk factors, and decide whether to halt the transaction for further investigation. This capability allows the bank to act swiftly—preventing fraud before it can escalate.

SimplAI's Role in Enhancing Real-Time Risk Assessment

SimplAI stands at the forefront of providing cutting-edge solutions for financial institutions looking to bolster their risk management capabilities. Our platform empowers organizations to build complex, high-accuracy AI applications, enabling them to:

- Enhance Fraud Detection: AI tools within our platform can help create unique customer behavior profiles, learning from each transaction to identify suspicious activities effectively.

- Automate Risk Assessments: SimplAI’s integration of predictive analytics ensures timely evaluations for credit risks and fraud, streamlining the compliance process.

- Scale Operations: With our solutions, financial institutions can effectively manage large data flows, ensuring seamless processing even as transaction volumes increase.

Conclusion: Embracing Real-Time Risk Management

The ability to conduct real-time risk assessments has become paramount for financial institutions looking to protect their assets and reputation in a fast-paced environment. With AI and machine learning offering advanced capabilities, firms can detect fraud, evaluate credit risks, and remain compliant with evolving regulations.

Are you ready to elevate your risk assessment strategies? How will your organization leverage real-time data analytics to stay ahead of potential threats?

At SimplAI, we are committed to enabling financial institutions to harness the power of real-time risk assessment in finance through innovative AI solutions. To explore how our platform can enhance your risk management capabilities, visit our website or book a demo today!