Streamlining Loan Approval Processes with AI

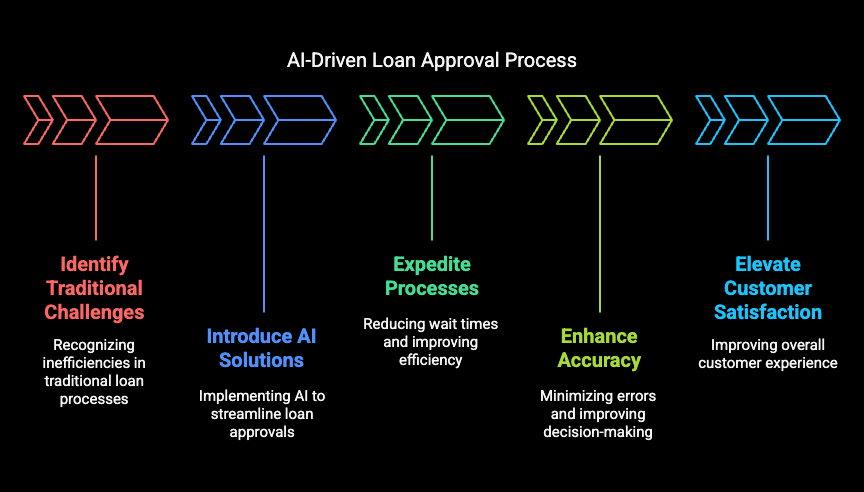

In today's fast-paced banking and finance sector, efficiency is paramount. Traditional loan approval processes often face challenges such as prolonged wait times, human errors, and reactive decision-making—all of which negatively impact the customer experience. Fortunately, AI loan approval automation is unlocking new possibilities for financial institutions, enabling them to expedite processes, enhance accuracy, and elevate customer satisfaction.

AI solutions like credit management AI and machine learning in loan underwriting are already at the forefront of advancement, providing innovative avenues to streamline BFSI processes. In this blog post, we will explore how artificial intelligence can revolutionize loan approval processes, highlight effective tools available, and demonstrate the notable benefits of integrating AI into these workflows.

How AI Loan Approval Works

AI loan approval can effectively enhance the entire loan approval journey through several key steps:

1. Data Classification and Extraction

AI agents are at work from the very beginning, classifying and extracting critical client data from various documents, including pay stubs, bank statements, and tax returns. Utilization of technologies like optical character recognition (OCR) and natural language processing (NLP) allows for efficient digitalization and identification of essential data points. For instance, when an applicant submits their financial documentation, AI systems can extract relevant information such as monthly income and validate tax details in one streamlined process.

2. Data Analysis

Once the information is extracted, AI agents analyze client data at impressive speeds, allowing for comprehensive assessments of creditworthiness and risk profiles. By utilizing analytical AI solutions, loan officers can access pertinent information quickly and make informed decisions supported by robust data. This process significantly reduces human error, bringing precision to credit risk assessments as changes in credit risk can be flagged instantly.

3. Compliance Audits

Adhering to regulatory standards is critical in the lending industry. Automated compliance checks performed by AI agents ensure that lending decisions are equitable and based on standardized criteria. AI reviews loan applications, weighing them against established regulations and company policies. This level of scrutiny reduces the chance of biased decision-making often seen in traditional systems.

4. Decision-Making Assistance

AI can suggest recommendations on loan approvals based on thorough data analysis while retaining human oversight. For example, if an AI agent flags an unusual pattern, it can prompt a manual review from an underwriter, merging the efficiency of AI with human expertise.

5. Post-Approval Monitoring

Even after loan approval, AI continues to play an essential role in monitoring borrowers' financial health. By observing repayment behavior and flagging potential red flags, AI supports financial institutions in maintaining fruitful client relationships and can identify opportunities for upselling or refinancing.

The Benefits of AI in Lending

Integrating AI into loan processing presents numerous advantages:

Speed and Efficiency

Moving from a manual review to an automated process can reduce loan approval times by up to 90%. By automating repetitive tasks such as document processing and data verification, AI allows lenders to engage with borrowers faster, providing a seamless experience.

Improved Accuracy

AI solutions not only enhance speed but also precision. Algorithms can reduce human error, enabling fairer lending practices and facilitating fraud detection by analyzing discrepancies within an applicant's data.

Scalability

AI allows lenders to manage increased loan applications without a proportional rise in resources. As loan demand fluctuates, AI enables real-time adjustments, thus maintaining operational efficiency.

Enhanced Customer Experience

By ensuring faster approval times and maintaining consistent communication throughout the lending process, AI improves customer satisfaction and strengthens trust in financial institutions. Personalized loan offers based on financial profiles augment the positive lending experience.

Compliance

AI simplifies regulatory compliance by automating checks and generating necessary documentation. With consistent decision-making processes and real-time audits, lenders can confidently demonstrate adherence to regulations throughout the loan lifecycle.

Conclusion

The integration of AI in loan processing is a game-changer, offering banks and financial institutions a pathway to efficiency, accuracy, and customer satisfaction. By leveraging here AI as a tool for automation and decision-making enhancement, lenders can thrive in today's competitive landscape.

Are you considering implementing AI for loan approvals? What challenges do you anticipate? Share your thoughts in the comments below!

Explore how SimplAI can help revolutionize your lending practices today—visit SimplAI!