The Impact of AI on Investment Strategies

In an era marked by rapid technological advancements, artificial intelligence in finance stands out as a pivotal driver of transformation within the investment landscape. From stock analysis to portfolio management, AI investment strategies are reshaping how investment bankers and financial institutions operate, respond to market dynamics, and ultimately enhance returns for their clients.

The integration of AI tools into investment strategies marks a significant transition. Traditional methods, often grounded in human intuition and fundamental analysis, are being complemented—and in some cases, replaced—by data-driven approaches that capitalize on vast datasets and powerful algorithms.

Understanding AI-Powered Investment Strategies

AI has revolutionized investment processes by enabling the analysis of extensive volumes of data with unprecedented speed and accuracy. Instead of relying solely on historical performance or qualitative insights, investment professionals can utilize AI-driven investment tools to forecast market movements and inform asset allocation decisions based on real-time data.

For instance, machine learning algorithms can identify hidden patterns within market data, providing investment bankers with competitive insights that were previously unattainable. These capabilities underscore the necessity for modern investment strategies to harness AI’s analytical power, transitioning investment analysis from subjective to objective.

Strengthening Risk Management with AI

The application of AI in risk management is another critical area. Traditional risk assessment methodologies often struggle to adapt to the complexities of today's markets. However, integrating AI solutions allows for more sophisticated risk profiles that can monitor market fluctuations and manage exposure dynamically. By leveraging AI credit management solutions, investment banks can mitigate potential losses and maintain robust portfolios in fluctuating conditions.

AI's Influence on Investment Research

Artificial intelligence is also transforming the way investment research is conducted. By processing both structured and unstructured datasets—ranging from financial statements to market sentiment analysis found in news articles and social media—AI enables investment professionals to uncover new opportunities with a speed and precision that human analysts cannot match.

For example, sophisticated natural language processing (NLP) algorithms can evaluate sentiment from earnings calls and social media. This technique allows for real-time sentiment analysis which can signal potential price movements ahead of traditional indicators. As demonstrated by several industry leaders, AI enhances the depth and breadth of investment insights, facilitating informed decision-making.

SimplAI: Empowering AI Investment Strategies

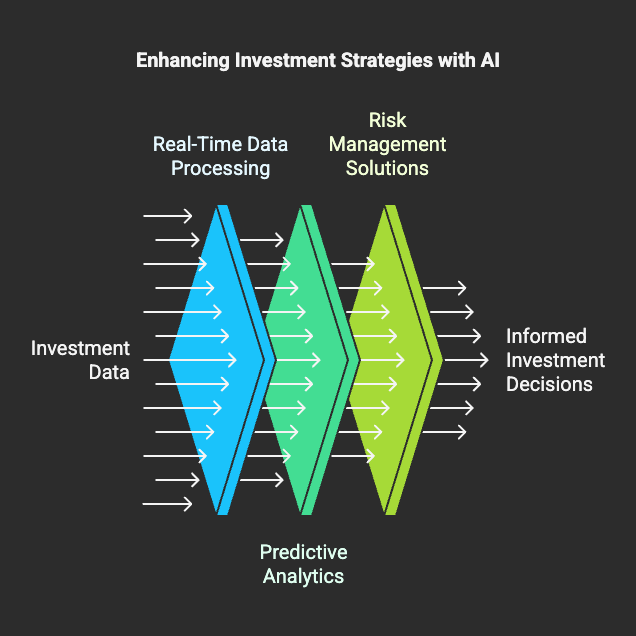

At SimplAI, we recognize that the implementation of AI in investment strategies can be daunting. By providing a robust, user-friendly platform, we enable investment bankers to seamlessly integrate AI into their operations. Our AI-driven investment tools are designed to help financial institutions leverage data analytics and machine learning, enhancing their investment processes with:

- Real-Time Data Processing: Swiftly analyze vast datasets for actionable insights.

- Predictive Analytics: Employ advanced algorithms to forecast market trends accurately.

- Risk Management Solutions: Optimize portfolios while mitigating exposure to potential losses.

Our solutions empower investment professionals to navigate the complexities of today's financial markets effectively while making informed decisions that drive better outcome for clients.

Conclusion

The impact of AI on investment strategies is profound. As we continue to see rapid growth in the adoption of AI-driven investment tools, the landscape of finance is evolving before our eyes. Investment bankers who leverage these technologies can achieve improved precision in their decision-making processes, ultimately increasing their competitive edge.

How is your firm planning to integrate AI-powered solutions in its investment strategy?

Explore SimplAI today and discover how our innovative tools can redefine your investment approach for the future.