The Role of AI in Modern Banking Operations

In today's fast-paced financial landscape, the role of Artificial Intelligence (AI) in banking has become paramount. With customer expectations evolving and competition from fintech companies intensifying, banks are tasked with rethinking their operational strategies. AI is not just a buzzword; it is actively reshaping how financial institutions operate, enhancing efficiency, personalization, and security. This blog delves into the various dimensions of AI's impact on banking operations, highlighting key applications, challenges, and the future potential of this technology.

Understanding AI in Banking

Artificial Intelligence encompasses a variety of technologies—including machine learning, natural language processing, and data analytics—that enable systems to mimic human intelligence. Banks leverage these technologies to streamline processes, enhance customer experiences, and improve decision-making performance. Approximately 80% of banks recognize the significant advantages AI brings to their operations, as supported by insights from recent studies.

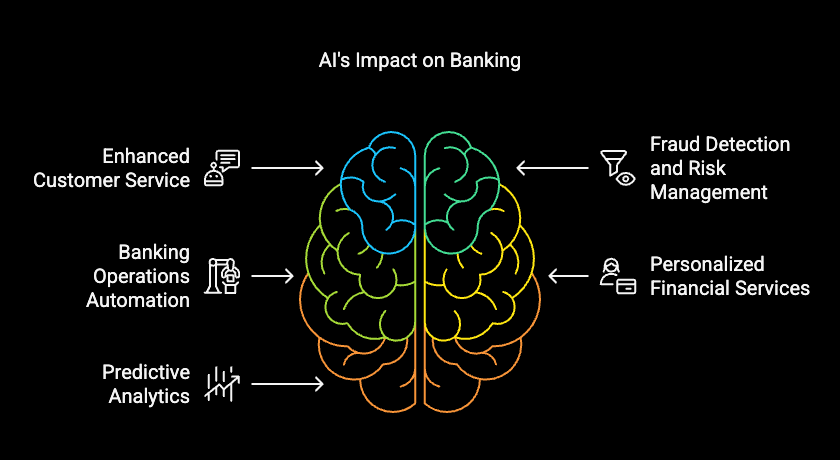

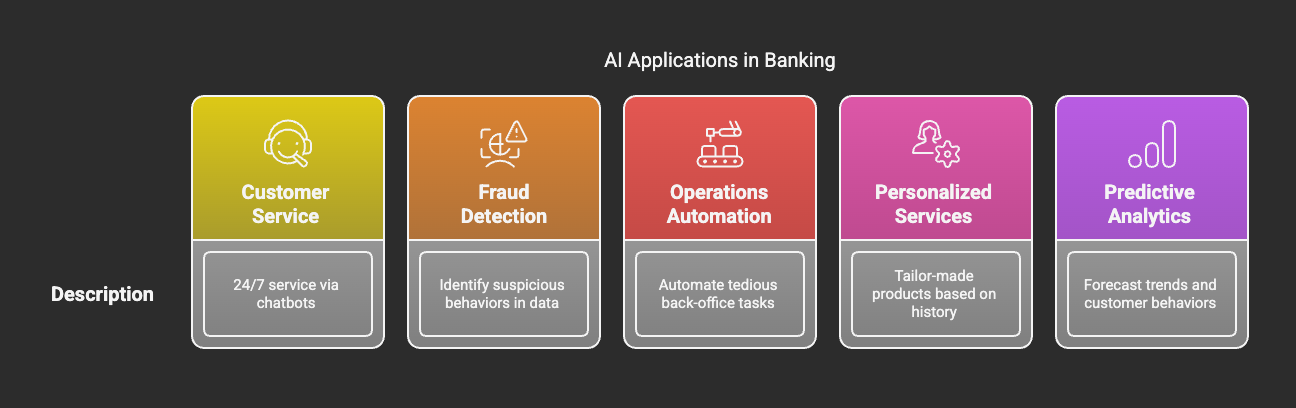

Key Applications of AI in Banking

- Enhanced Customer Service: AI-driven chatbots and virtual assistants are becoming the first point of contact for many banks, enhancing customer interactions by providing 24/7 service. For example, Bank of America's chatbot, Erica, has surpassed 1.5 billion interactions, illustrating the power of AI to handle inquiries in real-time.

- Fraud Detection and Risk Management: AI algorithms excel in analyzing vast amounts of data to identify suspicious behaviors, thus significantly mitigating fraud risks while ensuring compliance. Financial institutions are increasingly embedding machine learning in their credit management processes, allowing for more accurate risk assessments.

- Banking Operations Automation: AI streamlines back-office operations by automating tedious tasks such as data entry, document verification, and anti-money laundering activities. This not only reduces operational costs but also minimizes human error, thereby enhancing the efficiency of banking operations.

- Personalized Financial Services: Utilizing data analytics, banks can offer tailor-made products and services to consumers based on their financial history and preferences. Credit Management AI generates customized loan options or investment advice, allowing for a more engaging banking experience for customers.

- Predictive Analytics: AI enhances predictive analytics capabilities within financial institutions, helping banks forecast trends and customer behaviors. By analyzing transaction patterns, banks can make informed decisions on product offerings and risk management.

Challenges in AI Implementation

While the benefits are substantial, AI adoption in the banking sector is not without challenges:

- Data Security Issues: With the rise of AI comes the increased need for robust data security measures. Banks must safeguard sensitive customer information against breaches and unauthorized access.

- Quality Data Shortage: High-quality, structured data is essential for effective AI deployments. Without it, algorithms may falter, leading to poor customer experiences or financial losses.

- Explainability of AI Models: Many AI systems function as "black boxes," making it difficult for banks to interpret how decisions are made. Ensuring that AI decisions are explainable is vital for maintaining customer trust and regulatory compliance.

The Future of AI in Banking: A Vision Ahead

Looking forward, the integration of AI with blockchain technology holds promising potential for transforming banking operations even further. This synergy can lead to more secure and efficient operational frameworks that enhance transaction integrity and processing speed.

Investment in AI is expected to surge, with global spending projected to reach over $126 billion by 2028, according to industry reports. As banks adapt, they will need to embrace a customer-centric approach, employing AI to personalize services and streamline interactions.

SimplAI's Solutions

At SimplAI, we recognized the urgent need for financial institutions to embrace AI-driven solutions. Our platform provides the fastest and simplest way to implement AI-powered tools tailored specifically for the banking sector. By addressing challenges in operational efficiency, customer engagement, and fraud detection, our solutions empower banks to innovate and excel in an increasingly competitive landscape.

Call to Action

As the banking industry continues to evolve, how can your organization leverage AI to improve operations and enhance customer satisfaction? Explore the possibilities with SimplAI and take the first step toward revolutionizing your banking experience with AI today!

The transformative role of AI in banking signifies a future filled with innovation and enhanced customer engagement. With rapid advancements in technology and an unwavering commitment to security and efficiency, the time to integrate AI into banking operations is now. Let's embark on this journey together!