Understanding Credit Proposal Generation: How SimplAI’s Credit Analyst AI Agent Solves Key Challenges

In the dynamic landscape of banking and finance, navigating the intricacies of credit proposal generation is critical. Financial institutions face an ever-increasing demand for speed and accuracy in assessing creditworthiness. Amidst this backdrop, SimplAI's Credit Analyst AI Agent shines as a beacon of efficiency and emerges as a game-changer, addressing key challenges within credit management.

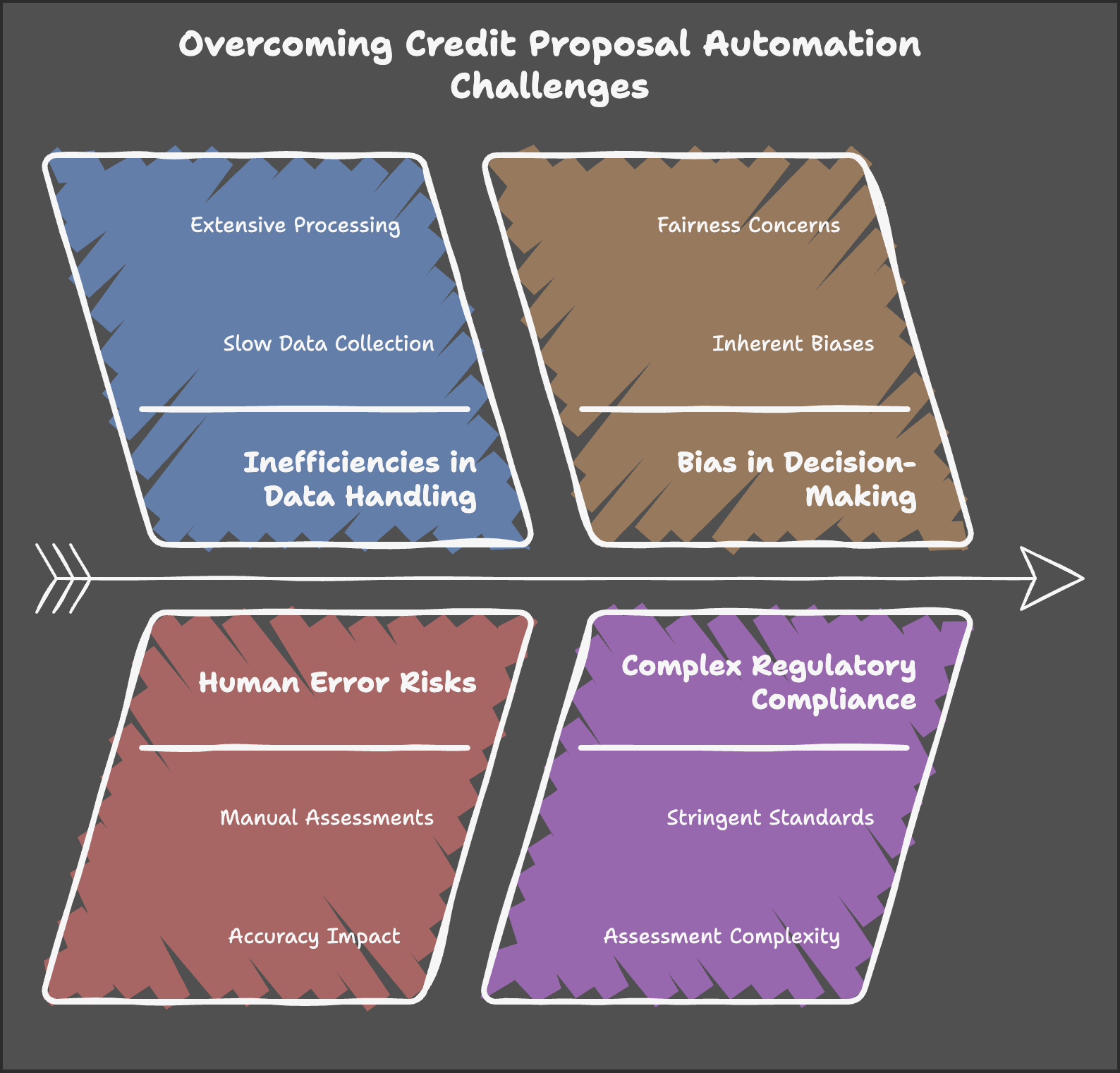

The Challenges in Credit Proposal Automation

As banking institutions grapple with traditional methods of credit proposal generation, they encounter significant hurdles:

- Inefficiencies in Data Handling: Manual credit assessments can be slow, requiring extensive data collection and processing, leading to delays in decision-making.

- Human Error Risks: Traditional methods are often fraught with human error, impacting the accuracy of credit decisions.

- Bias in Decision-Making: There's an ever-present concern regarding inherent biases that may affect the fairness of credit evaluations.

- Complex Regulatory Compliance: Financial institutions must adhere to stringent regulatory standards, adding layers of complexity to credit assessments.

Addressing these challenges requires an innovative approach that leverages cutting-edge technology.

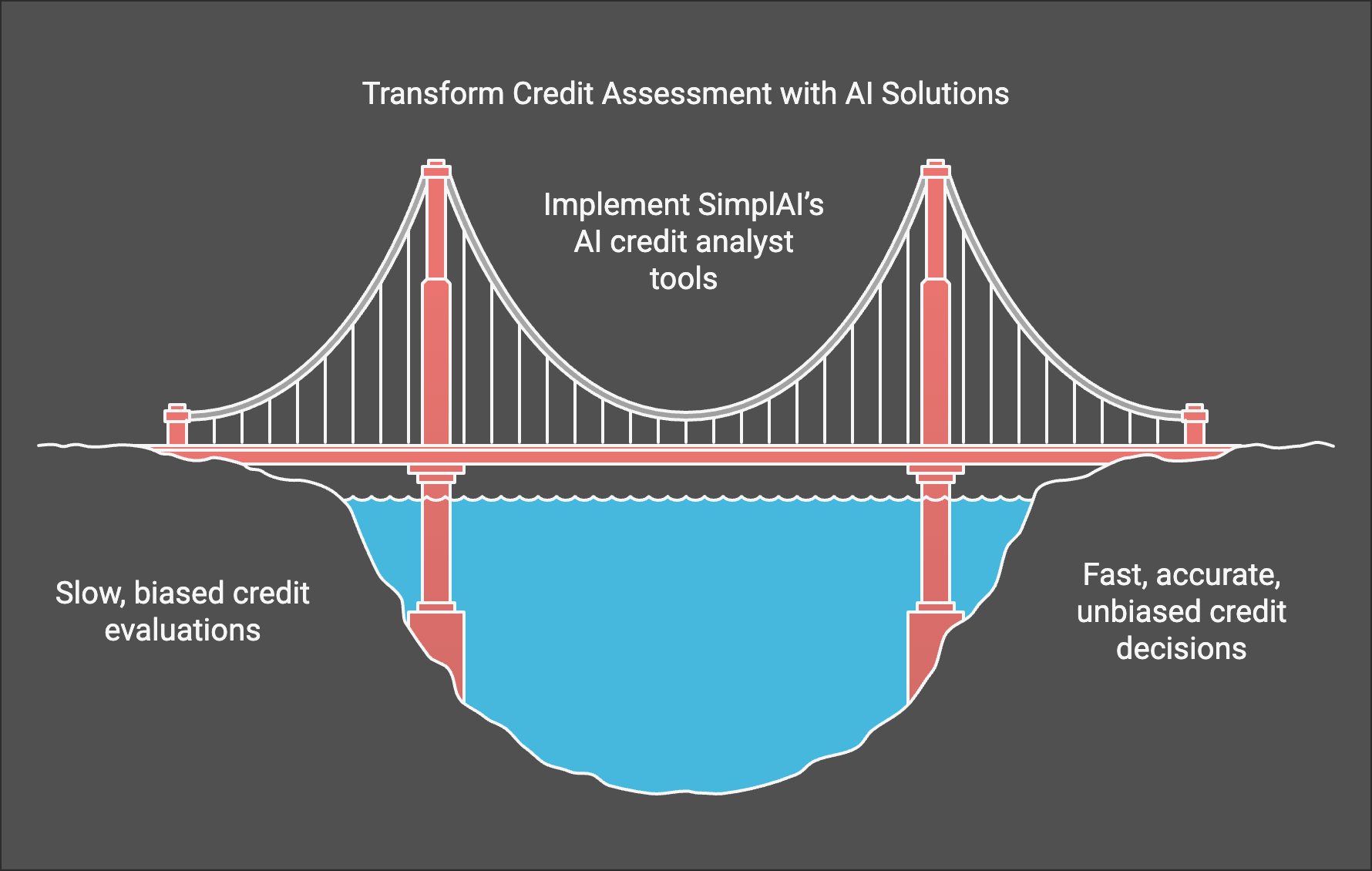

How SimplAI’s Credit Analyst AI Agent Transforms the Process

- Streamlined Data Processing and Analysis

SimplAI’s Credit Analyst AI Agent uses advanced algorithms to swiftly gather and analyze vast datasets, allowing institutions to generate credit proposals efficiently. This accelerates the overall credit evaluation process, substantially reducing turnaround times. - Enhanced Accuracy Through Machine Learning

The AI agent integrates machine learning capabilities to predict creditworthiness more precisely. This technology continuously learns from new data, evolving its assessments to match real-time economic conditions. By processing traditional and alternative data sources, such as social media behaviour or transaction histories, SimplAI enhances the quality of insights generated. - Reduction of Human Bias

With AI taking a central role in credit assessments, the standardization of decision-making processes minimizes the risks associated with human biases. The AI in credit management ensures decisions are based on objective data rather than subjective judgment. - Improved Compliance and Risk Management

SimplAI's Credit Analyst AI Agent closely track changes in regulations, automatically adjusting the credit assessment parameters to ensure compliance. Integrating risk management protocols into the AI framework enables proactive identification and mitigation of potential credit risks.

The Broader Implications of AI in Credit Proposal Generation

The integration of SimplAI's Agent for credit assessment provides an overarching benefit by transforming credit proposal generation into a comprehensive, efficient, and responsive process. Institutions not only improve their operational efficiency but also enhance customer experience. As AI continues to take centre stage in credit risk management, customers can expect faster and more accurate financing decisions.

Real-World Application: Case Studies

For example, a financial institution utilizing SimplAI's Agent experienced a drastic reduction in the average time taken to process credit applications from weeks to mere days. This efficiency resulted in higher customer satisfaction and improved retention rates as clients appreciated the quick turnaround.

Conclusion

In the competitive realm of financial services, the ability to generate accurate credit proposals swiftly sets institutions apart. As challenges in credit proposal automation persist, SimplAI's Credit Analyst AI Agent emerges as a transformative solution. By streamlining operations, improving accuracy, and mitigating biases, it empowers financial institutions to deliver exceptional services efficiently.

How do you see AI enhancing your organization's credit processes? Share your thoughts below!

For institutions seeking to revolutionize their credit management framework, booking a demo with SimplAI is the first step toward a smarter, more efficient future. Explore how our solutions can be tailored to your needs today!

How do you envision using credit proposal generation using AI to enhance your organization's credit processes? Share your thoughts below!

For institutions looking to revolutionize their credit management framework, booking a demo with SimplAI could be your first step toward a smarter, more efficient future. Explore how we can help tailor our innovative solutions to your needs today!