Agentic automation for lending operations

SimplAI Agentic Automation for Loan Processing

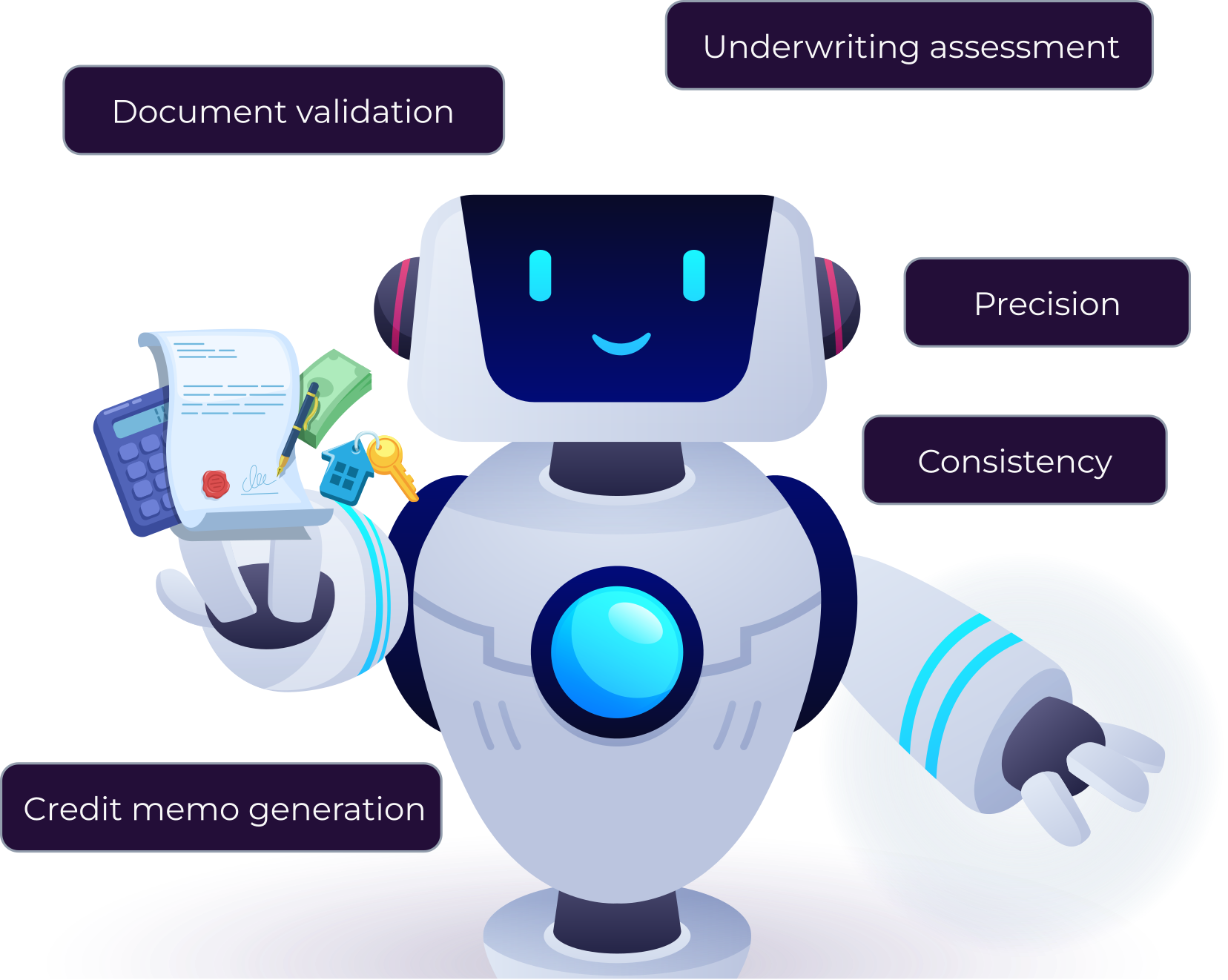

SimplAI automates document validation, underwriting assessment, and credit memo generation—leveraging agentic AI workflows to accelerate lending decisions with precision and consistency.

Why SimplAI?

How SimplAI transforms loan processing?

01

Instant, context-aware document processing

Manual document reviews are slow and error-prone—SimplAI’s agentic automation extracts, classifies, and validates data instantly, accelerating loan processing.

Process 70+ document types, including PDFs, doc,emails, and scanned images.

Ensure structured data extraction for faster decision-making in loan processing.

02

Automated risk & compliance checks

Manual risk assessment creates inconsistencies—SimplAI automates compliance verification, fraud detection, and applicant profiling for seamless loan processing and risk management.

Conduct real-time bureau checks, deduplication, and reference verification.

Ensure policy alignment with automated SOP and checklist validation.

04

Automated credit memo & proposal generation

Tedious manual drafting is a thing of the past—SimplAI generates loan documentation with AI-generated memos and proposals.

Auto-generate institution-ready documents with customizable templates. Maintain compliance and accuracy across all loan documentation.

Maintain consistency and compliance across loan documentation.

Results that matter

SimplAI eliminates bottlenecks in loan processing by automating document validation, credit assessment, and decisioning—delivering accuracy, speed, and scalability.

Accuracy

95%

Reliable document validation and credit assessment

Faster Turnaround

50%

Reduction in time spent on CAM (Credit Appraisal Memo) creation

Consistency

100%

Standardized loan processing across all cases

Efficiency

80%

Reduction in manual effort for document verification and risk checks

Scales loan operations

Reduces dependency on manual workflows, accelerating loan approvals with uniform and accurate decisioning.

Automated document intelligence

Extracts, validates, and organizes data from documents instantly, reducing manual review time.

Multi-agent AI for loan processing

Dedicated AI agents handle document validation, risk analysis, and decision-making—adapting and improving continuously.

Plug & play integration

Connect effortlessly with Loan origination systems, credit risk engines, and underwriting platforms.

Deploy with confidence

Choose cloud or on-premise to meet compliance, security, and performance needs.

Enterprise-grade security

Data encryption with full compliance to industry regulations (SOC 2, ISO 27001).

Get latest insights on Agentic AI