Faster loans. Smarter workflows. Happier borrowers.

Your Mortgage Stack — Now Powered by Agentic AI

Automate origination, underwriting, and servicing with intelligent agents that plug into your existing LOS.

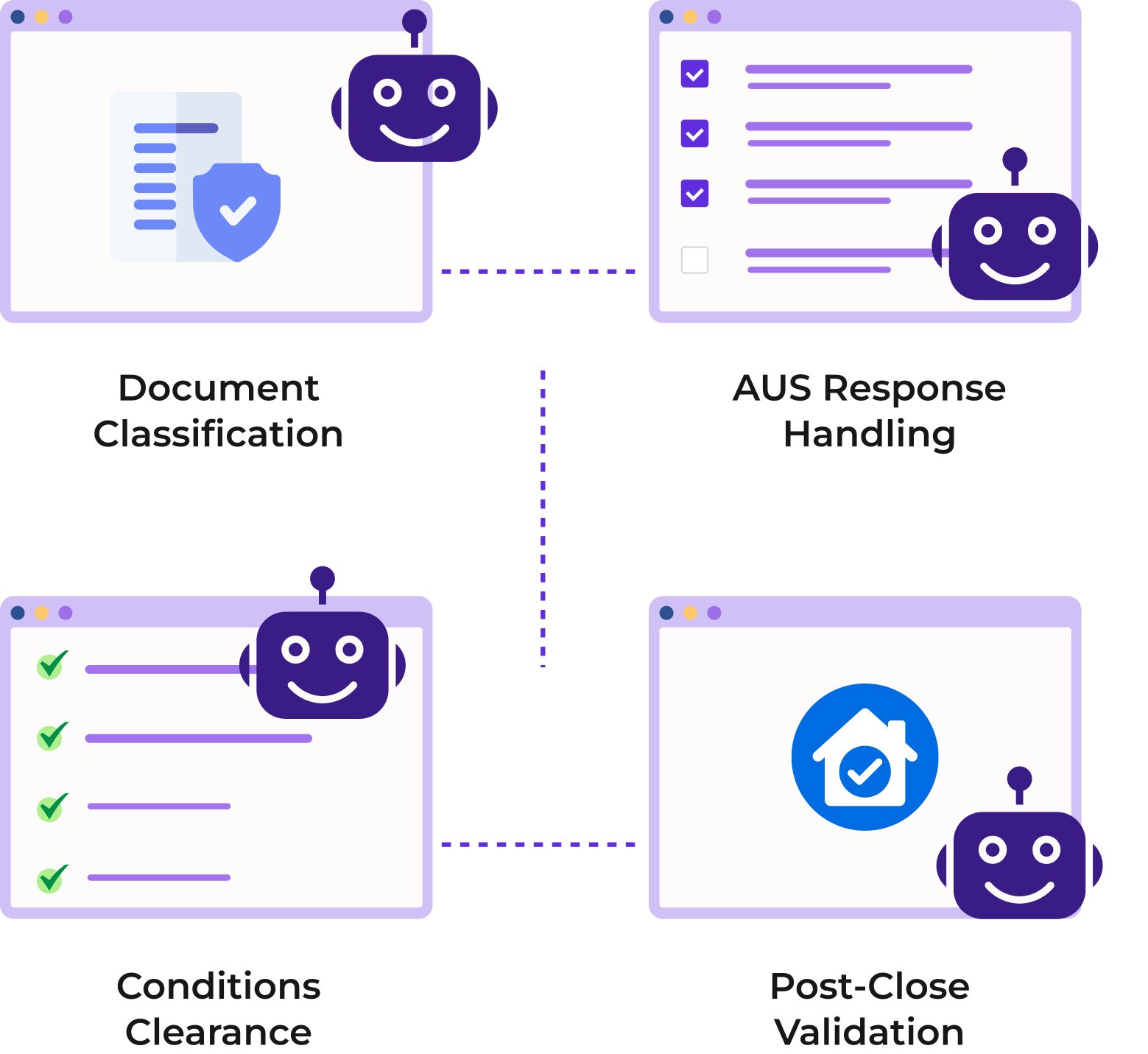

AI That Works Like a Teammate - Across

the Entire Mortgage Lifecycle

the Entire Mortgage Lifecycle

Why Leading Lenders Choose SimplAI

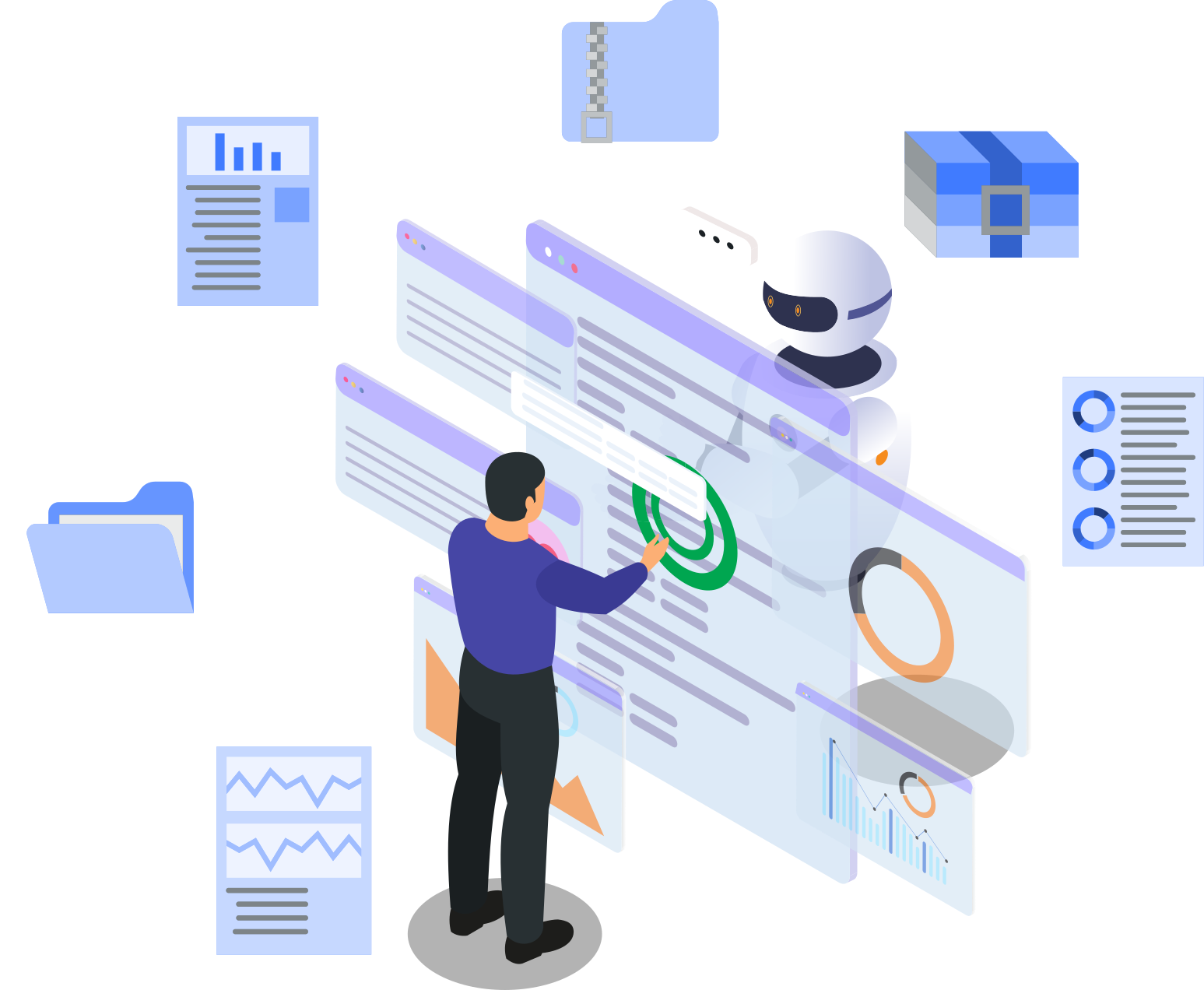

Built for End-to-End Lending

Not just intake - our agents automate condition clearance, post-close audits, and more.

Works With Your LOS

Seamlessly integrates with leading LOS and core banking platforms - no rip-and-replace needed.

No Job Displacement

Agents support your processors — freeing them from repetitive tasks, not replacing them.

FAQs

Get latest insights on Agentic AI