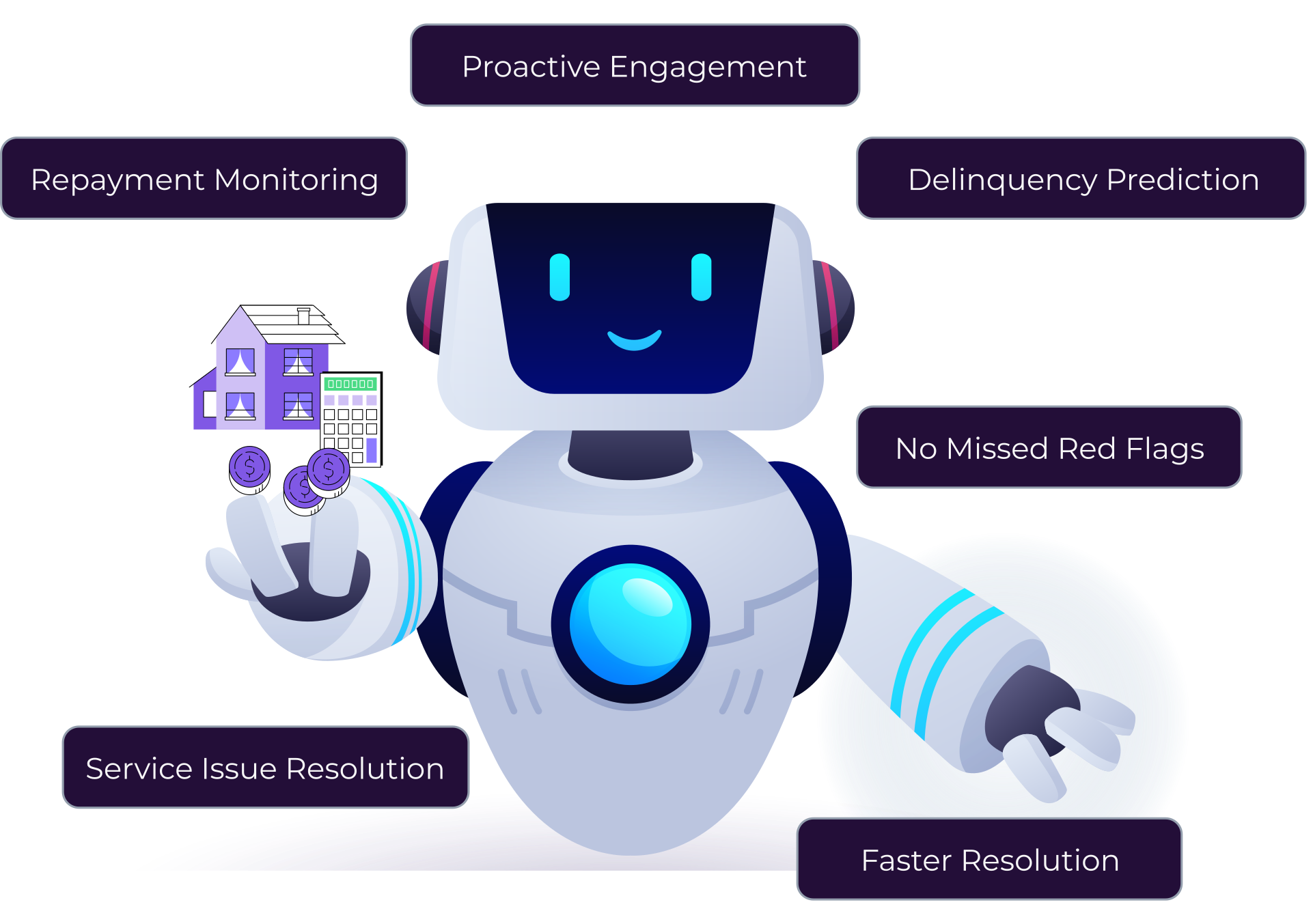

Stay Ahead of Delinquency - and Keep Borrowers Happier

SimplAI Mortgage Servicing Agentic Workflow

AI agents that monitor repayments, engage at-risk borrowers, and resolve service issues — no delays, no missed red flags.

Why SimplAI?

How SimplAI Transforms Mortgage Servicing

Real-Time Multi-Agent Workflows

Specialized agents for outreach, service Q&A, and payoff — all with context and memory.

Integrates With Your Stack

Connects via API or middleware with MSP, Jack Henry, Fiserv, or custom systems.

Personalized Borrower Engagement

Channels, timing, and tone adapt to borrower behavior and risk signals.

Proactive Risk Escalation

Detects early red flags and routes files to your loss mitigation team.

Always Audit-Ready

Logged, explainable actions aligned with CFPB, GLBA, and internal compliance protocols.

Better Borrower Experience

Resolves 60%+ of requests instantly — no wait times, no frustration.

Get latest insights on Agentic AI